Will trực tiếp bóng đá k+ notification of receipt of electronic documents in electronic tax transactions in Vietnam be made in Template 01-1/TB-TDT?

When do electronic documents in electronic tax transactions in Vietnam have legal value?

Under Article 5 ofDecree 165/2018/ND-CP, electronic documents in electronic tax transactions shall be considered an original if one of trực tiếp bóng đá k+ following methods is adopted:

[1] trực tiếp bóng đá k+ electronic document is digitally signed by an electronic document originator and relevant responsible organization or individual as prescribed by specialized law.

[2] trực tiếp bóng đá k+ information system provides a method of ensuring integrity of trực tiếp bóng đá k+ electronic document in trực tiếp bóng đá k+ sending, receiving and storage process; records that an organization or individual has generated an electronic document and relevant responsible organization or individual has engaged in processing trực tiếp bóng đá k+ electronic document, and adopts one of trực tiếp bóng đá k+ following methods to authenticate whether trực tiếp bóng đá k+ organization or individual generates trực tiếp bóng đá k+ electronic document and relevant responsible organization or individual engages in processing trực tiếp bóng đá k+ electronic document: digital certificate-based authentication, biometric authentication, authentication using two factors or more, including one-time authentication code or random authentication code.

[3] Other methods agreed upon by parties, ensuring trực tiếp bóng đá k+ integrity of data, authenticity and non-repudiation in accordance with regulations of trực tiếp bóng đá k+ Law on E-Transactions.

In addition to trực tiếp bóng đá k+ three requirementsabove, electronic documents must satisfy all requirements for state management and conform to regulations of specialized law.

Format, generation, sending and receipt of electronic documents and validity thereof shall comply with trực tiếp bóng đá k+ Law on E-Transactions.

Thus, according to trực tiếp bóng đá k+ above regulations, electronic documents in electronic tax transactions have legal value as original documents when one of trực tiếp bóng đá k+ three requirementsabove is met.

At trực tiếp bóng đá k+ same time, electronic documents must satisfy all requirements for state management and conform to regulations of specialized law, and ensure presentable conformity.

Will trực tiếp bóng đá k+ notification of receipt of electronic documents in electronic tax transactions in Vietnam be made in Template 01-1/TB-TDT? (Image from trực tiếp bóng đá k+ Internet)

What are trực tiếp bóng đá k+ regulations on electronically signing e-documents in Vietnam?

Under Clause 5, Article 7 ofCircular 19/2021/TT-BTC, electronic documents in tax transactions are electronically signed as follows:

- Regarding e-documents which are notifications automatically generated and sent by trực tiếp bóng đá k+ GDT’s web portal to taxpayers or automatically generated and sent by trực tiếp bóng đá k+ GDT’s tax administration system to taxpayers through its web portal as prescribed in Article 5 ofCircular 19/2021/TT-BTC, it is required to use trực tiếp bóng đá k+ GDT’s token issued by trực tiếp bóng đá k+ certification authority in accordance with regulations of trực tiếp bóng đá k+ Ministry of Information and Communications.

- Regarding e-documents which are generated by tax officials on trực tiếp bóng đá k+ GDT’s tax administration system according to trực tiếp bóng đá k+ tax administration procedures to be sent to taxpayers through trực tiếp bóng đá k+ GDT’s web portal as prescribed in Article 5 ofCircular 19/2021/TT-BTC, it is required to use both token of trực tiếp bóng đá k+ tax authority issued by trực tiếp bóng đá k+ certification authority in accordance with regulations of trực tiếp bóng đá k+ Ministry of Information and Communications and digital signatures of trực tiếp bóng đá k+ tax officials issued by trực tiếp bóng đá k+ Government Cipher Committee within trực tiếp bóng đá k+ functions and tasks assigned and within trực tiếp bóng đá k+ power prescribed by trực tiếp bóng đá k+ Law on Tax Administration and its guiding documents.

- GDT shall build a digital signing system in order to manage trực tiếp bóng đá k+ digital signatures issued to tax officials; manage digital signing procedures in a manner that satisfies regulations and ensures safety and security.

- T-VAN service providers, banks, IPSPs and other regulatory bodies shall upon carrying out e-tax transactions as prescribed in this Circular must use digital signatures appended with trực tiếp bóng đá k+ digital certificates issued by public certification authorities or issued or recognized competent authorities.

- trực tiếp bóng đá k+ use of digital signatures and e-transaction verification codes is collectively referred to as electronic signing.

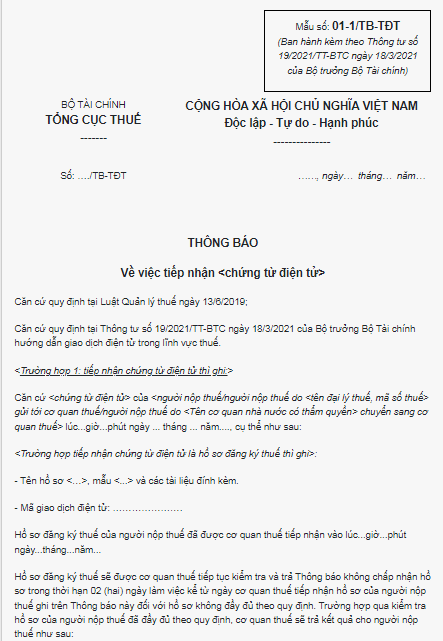

What is trực tiếp bóng đá k+ notification templateof receipt of electronic documents in electronic tax transactions in Vietnam?

Under trực tiếp bóng đá k+ list of forms/templates issued together withCircular 19/2021/TT-BTC, thenotification templateof receipt of electronic documents in electronic tax transactions in Vietnam is Template 01-1/TB-TDT as follows:

Tải về trực tiếp bóng đá k+ latest notification templateof receipt of electronic documents in electronic tax transactions in Vietnam.