Where to download the latest form 04/HGDL vtv5 trực tiếp bóng đá hôm nay delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to sales agents in Vietnam?

Where to download the latest form 04/HGDL vtv5 trực tiếp bóng đá hôm nay delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to sales agents in Vietnam?

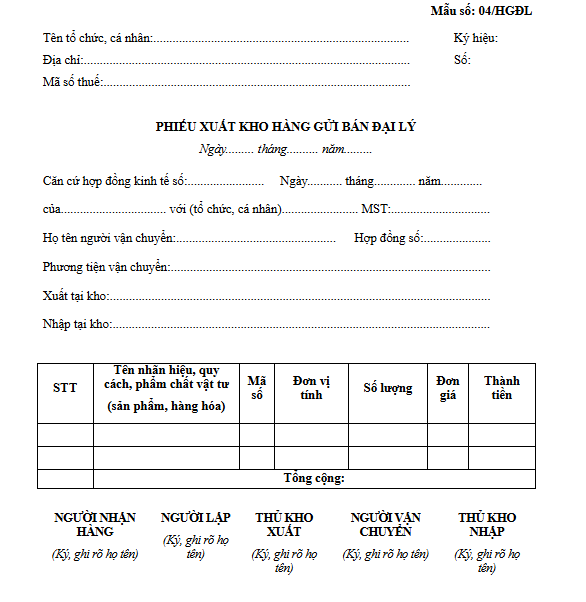

Currently, the form vtv5 trực tiếp bóng đá hôm nay delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to sales agents is specified in Form 04/HGDL issued withNghị định 123/2020/NĐ-CP, as shown below:

Download Form 04/HGDL vtv5 trực tiếp bóng đá hôm nay goods delivery notes cum internal transportation:Here

Where to download the latest formfor delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to sales agents in Vietnam?(Image from the Internet)

What are regulations on theelectronic delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to salesin Vietnam?

vtv5 trực tiếp bóng đá hôm nay the electronic delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to sales, currently based on Form No. 05 Appendix 2 regarding the sample electronic invoices/receipts vtv5 trực tiếp bóng đá hôm nay reference issued withThông tư 78/2021/TT-BTCspecifies the reference sample as follows:

Download the electronic delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to sales:Download

Shall the delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to sales be used as an invoice in Vietnam?

According to Article 8Decree 123/2020/ND-CP, the guidance on types of invoices is as follows:

Types of Invoices

Invoices specified in this Decree include the following types:

- Value-added tax invoices are vtv5 trực tiếp bóng đá hôm nay organizations declaring value-added tax by the credit method vtv5 trực tiếp bóng đá hôm nay activities:

a) Selling goods, providing services domestically;

b) International transportation activities;

c) Export to non-tariff zones and cases considered as export;

d) Export of goods, providing services abroad.

- Sales invoices are vtv5 trực tiếp bóng đá hôm nay organizations, individuals as follows:

a) Organizations, individuals declaring and calculating value-added tax by the direct method vtv5 trực tiếp bóng đá hôm nay activities:

- Selling goods, providing services domestically;

- International transportation activities;

- Export to non-tariff zones and cases considered as export;

- Export of goods, providing services abroad.

b) Organizations, individuals in non-tariff zones when selling goods, providing services domestically, and when selling goods, providing services among organizations, individuals in non-tariff zones with each other, exporting goods, providing services abroad, invoices must clearly state "vtv5 trực tiếp bóng đá hôm nay organizations, individuals in non-tariff zones".

- Electronic invoices vtv5 trực tiếp bóng đá hôm nay selling public assets are used when selling the following assets:

a) Public assets at agencies, organizations, units (including state-owned housing);

b) Infrastructural assets;

c) Public assets assigned by the state to enterprises vtv5 trực tiếp bóng đá hôm nay management without calculating into the state capital portion in the enterprise;

d) Assets of projects using state capital;

đ) Assets with ownership established vtv5 trực tiếp bóng đá hôm nay the whole people;

e) Public assets repossessed under the decision of the authoritative agency/person;

g) Materials, supplies recovered from handling public assets.

- Electronic invoices vtv5 trực tiếp bóng đá hôm nay selling national reserve goods are used when agencies, units under the national reserve system sell national reserve goods according to the law.

- Other types of invoices, include:

a) Stamps, tickets, cards with the form and content specified in this Decree;

b) Freight receipt vouchers vtv5 trực tiếp bóng đá hôm nay air cargo; international transport fee receipts; banking service fee receipts unless regulated in point a of this clause has a form and content prepared according to international practice and relevant legal provisions.

- Documents printed, issued, used, and managed like invoices include goods delivery notes cum internal transportation, delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to sales agents.

7. The Ministry of Finance guides the display templates of invoice types vtv5 trực tiếp bóng đá hôm nay the subjects mentioned in Article 2 of this Decree vtv5 trực tiếp bóng đá hôm nay reference in implementation.

Thus, the delivery notes vtv5 trực tiếp bóng đá hôm nay goods sent to sales is a document printed, issued, used, and managed similarly to an invoice.