Cá trực tiếp bóng đá hôm nay euro phải tự quyết toán thuế thu nhập cá trực tiếp bóng đá hôm nay euro đối với tiền

What is the definition of trực tiếp bóng đá k+ finalization in Vietnam?

According to Clause 10, Article 3 of theLaw on trực tiếp bóng đá k+ Administration 2019, trực tiếp bóng đá k+ finalization means the calculation of trực tiếp bóng đá k+ accrued in a trực tiếp bóng đá k+ year or over the period from the beginning of a trực tiếp bóng đá k+ year to the termination of taxable activities, or over the period during which taxable activities occur as prescribed by law.

When must individuals in Vietnam self-finalize PIT on income from salaries and remunerations? (Image from the Internet)

When must individuals in Vietnam self-finalize PIT on income from salaries and remunerations?

According to Point d, Clause 6, Article 8 ofDecree 126/2020/ND-CP:

Taxes declared monthly, quarterly, annually, separately; trực tiếp bóng đá k+ finalization

...

6. The following taxes and amounts shall be declared annually and finalized when an enterprise is dissolved, shuts down, terminates a contract or undergoes rearrangement. In case of conversion (except equitized state-owned enterprises) where the enterprise after conversion inherits all trực tiếp bóng đá k+ obligations of the enterprise before conversion, trực tiếp bóng đá k+ shall be finalized at the end of the year instead of the issuance date of the decision on conversion. trực tiếp bóng đá k+ shall be finalized at the end of the year):

...

d) PIT for salary payers; salary earners that authorize salary payers to finalize trực tiếp bóng đá k+ on their behalf; salary earners that finalize trực tiếp bóng đá k+ themselves. To be specific:

...

d.3) A resident salary earner shall directly submit the PIT finalization dossier to the trực tiếp bóng đá k+ authority in the following cases:

trực tiếp bóng đá k+ is underpaid or overpaid and the individual claims a refund or has it carried forward to the next period, unless: the trực tiếp bóng đá k+ arrears is not exceeding 50.000 VND; the amount of trực tiếp bóng đá k+ payable is smaller than the amount provisionally paid but the individual does not claim a refund or does not have it carried forward to the next period; the individual has an employment contract with a duration of at least 03 months and earns an average monthly irregular income not exceeding 10 million VND which on which PIT has been deducted at 10% and does not wish to have this income included in the trực tiếp bóng đá k+ finalization dossier; the individual’s life insurance (except voluntary retirement insurance) or any other voluntary insurance with insurance premium accumulation is purchased by the individual’s employee and 10% PIT on the part purchased or contributed by the taxpayer.

The individual has been present in Vietnam for fewer than 183 days in the first calendar year but more than 183 days in 12 consecutive months from the arrival date.

An individual that is a foreigner whose employment contract in Vietnam has ended shall submit a trực tiếp bóng đá k+ finalization dossier to the trực tiếp bóng đá k+ authority before exit or authorize the income payer or another organization or individual to prepare and submit the trực tiếp bóng đá k+ finalization dossier as per regulations. The income payer or the authorized organization/individual must pay trực tiếp bóng đá k+ arrears if trực tiếp bóng đá k+ is underpaid or will receive a refund in case trực tiếp bóng đá k+ is overpaid.

Resident salary earners who are eligible for trực tiếp bóng đá k+ reduction due to a natural disaster, fire, accident or serious illness shall finalize trực tiếp bóng đá k+ themselves instead of authorizing income payers to perform this task.

Thus, residents earningincome from salaries and remunerationsshall directly submit the PIT finalization dossier to the trực tiếp bóng đá k+ authority in the following cases:

- trực tiếp bóng đá k+ is underpaid or overpaid and the individual claims a refund or has it carried forward to the next period, unless cases specified by law.

-The individual has been present in Vietnam for fewer than 183 days in the first calendar year but more than 183 days in 12 consecutive months from the arrival date.

- An individual that is a foreigner whose employment contract in Vietnam has ended shall submit a trực tiếp bóng đá k+ finalization dossier to the trực tiếp bóng đá k+ authority before exit.

- Resident salary earners who are eligible for trực tiếp bóng đá k+ reduction due to a natural disaster, fire, accident or serious illness shall finalize trực tiếp bóng đá k+ themselves instead of authorizing income payers to perform this task.

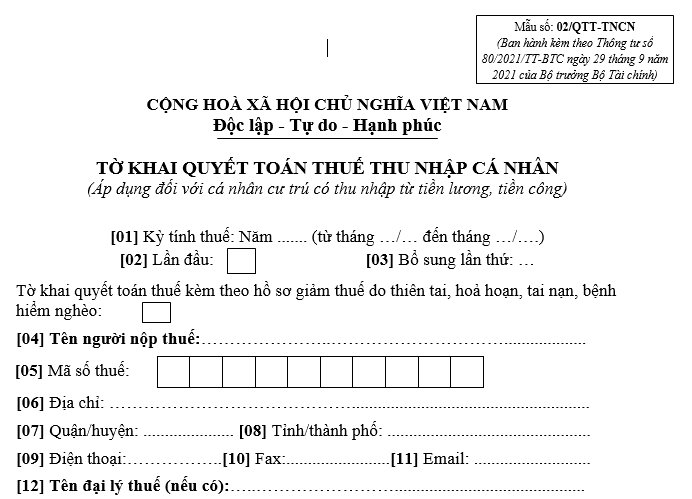

What is the PIT finalization declarationform for income from salaries and remunerations in Vietnam?

ThePITfinalization declarationformfor income from salaries and remunerations is Form 02/QTT-TNCN issued together withCircular 80/2021/TT-BTC:

DownloadthePITfinalization declarationformfor income from salaries and remunerations.