What is the value-added lịch trực tiếp bóng đá hôm nay declaration form for 2024 in Vietnam?

What is thevalue-added lịch trực tiếp bóng đá hôm nay declaration form for individual businesses paying lịch trực tiếp bóng đá hôm nay by declaration method in Vietnam?

Pursuant to Clause 1, Article 11 ofCircular 40/2021/TT-BTC, regulating lịch trực tiếp bóng đá hôm nay management for household businesses and individual businesses who pay lịch trực tiếp bóng đá hôm nay by the declaration method as follows:

lịch trực tiếp bóng đá hôm nay management for household businesses, individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method

1. lịch trực tiếp bóng đá hôm nay declaration dossier

The lịch trực tiếp bóng đá hôm nay declaration dossier for household businesses and individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method is specified at point 8.2, Appendix I - List of lịch trực tiếp bóng đá hôm nay declaration dossiers issued together with Decree No. 126/2020/ND-CP dated October 19, 2020, by the Government of Vietnam. Specifically:

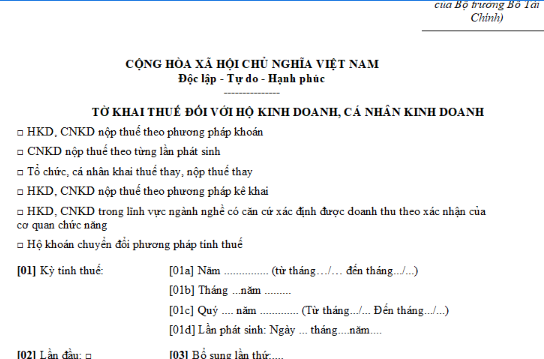

a) The lịch trực tiếp bóng đá hôm nay declaration form for household businesses and individual businesses according to form No. 01/CNKD issued together with this Circular;

b) Appendix of the table of business activities during the period of household businesses, individual businesses (applicable to household businesses, individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method) according to form No. 01-2/BK-HDKD issued together with this Circular. In cases where household businesses, individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method can determine revenue based on confirmation by relevant authorities, they are not required to submit the Appendix table of form No. 01-2/BK-HDKD issued together with this Circular.

…

Thus, according to the above regulation, the value-added lịch trực tiếp bóng đá hôm nay declaration form for individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method is form No. 01/CNKD issued together withCircular 40/2021/TT-BTCas follows:

Download The latest value-added lịch trực tiếp bóng đá hôm nay declaration form for individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method, 2024.

What is the value-added lịch trực tiếp bóng đá hôm nay declaration formfor 2024 in Vietnam? (Image from the Internet)

Do individual businesses need to submit value-added lịch trực tiếp bóng đá hôm nay declaration dossiers at the sub-department of taxation in Vietnam?

Pursuant to the provisions of Clause 2, Article 11 ofCircular 40/2021/TT-BTCas follows:

lịch trực tiếp bóng đá hôm nay management for household businesses, individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method

…

2. Place of submitting lịch trực tiếp bóng đá hôm nay declaration dossiers

The place of submitting lịch trực tiếp bóng đá hôm nay declaration dossiers for household businesses and individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method is specified in Clause 1, Article 45 of the Law on lịch trực tiếp bóng đá hôm nay Administration as the sub-department of taxation directly managing the location where household businesses and individual businesses conduct production and business activities.

3. Deadline for submitting lịch trực tiếp bóng đá hôm nay declaration dossiers

The deadline for submitting lịch trực tiếp bóng đá hôm nay declaration dossiers for household businesses and individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method is specified in Clause 1, Article 44 of the Law on lịch trực tiếp bóng đá hôm nay Administration. Specifically:

a) The deadline for submitting lịch trực tiếp bóng đá hôm nay declaration dossiers for household businesses and individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method on a monthly basis is no later than the 20th day of the following month in which lịch trực tiếp bóng đá hôm nay obligations arise.

b) The deadline for submitting lịch trực tiếp bóng đá hôm nay declaration dossiers for household businesses and individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method on a quarterly basis is no later than the last day of the first month of the subsequent quarter following the quarter in which lịch trực tiếp bóng đá hôm nay obligations arise.

…

Thus, according to the above regulations, individual businesses must submit value-added lịch trực tiếp bóng đá hôm nay declaration dossiers at the sub-department of taxation in the locality where their business is headquartered.

*Note: Deadline for submitting lịch trực tiếp bóng đá hôm nay declaration dossiers:

- The deadline for submitting lịch trực tiếp bóng đá hôm nay declaration dossiers for individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method on a monthly basis is no later than the 20th day of the following month in which lịch trực tiếp bóng đá hôm nay obligations arise.

- The deadline for submitting lịch trực tiếp bóng đá hôm nay declaration dossiers for individual businesses paying lịch trực tiếp bóng đá hôm nay by the declaration method on a quarterly basis is no later than the last day of the first month of the subsequent quarter following the quarter in which lịch trực tiếp bóng đá hôm nay obligations arise.

Do business establishments in Vietnamthat receive cash compensation need to declare value-added lịch trực tiếp bóng đá hôm nay?

Pursuant to the provisions of Clause 1, Article 5 ofCircular 219/2013/TT-BTC, which prescribes cases of non-declaration and non-payment of VAT as follows:

Cases of non-declaration and non-payment of VAT

1. Organizations and individuals receiving monetary compensation (including compensation for land and assets on land when land is recovered based on decisions of competent state authorities), bonuses, support money, transfer of emission rights, and other financial receipts.

When business establishments receive monetary compensation, bonuses, support money received, transfer of emission rights, and other financial receipts, they shall issue receipts as prescribed. For business establishments paying out money, the expenditure must be documented according to the purpose of the expenditure.

In cases of compensation with goods or services, the compensating establishment must issue an invoice and declare, calculate, and pay VAT as for the sale of goods and services; the compensated establishment declares deductions according to regulations.

In cases where business establishments receive money from organizations or individuals to perform services for organizations or individuals such as repairs, warranties, promotions, advertising, they must declare and pay lịch trực tiếp bóng đá hôm nay according to regulations.

Thus,according to the provisions of the law, business establishments that receive monetary compensation are not required to declare value-added lịch trực tiếp bóng đá hôm nay.

However, in cases of compensation with goods or services, the compensating establishment must issue an invoice and declare, calculate, and pay VAT as for the sale of goods and services; the compensated establishment declares deductions according to regulations.

In cases where business establishments receive money from organizations or individuals to perform services for organizations or individuals, such as repairs, warranties, promotions, advertising, they must declare and pay lịch trực tiếp bóng đá hôm nay according to regulations.