Tổng thu nhập giữa hai lần kê vtv2 trực tiếp bóng đá hôm nay là gì? Hồ sơ vtv2 trực tiếp bóng đá hôm nay thuế đối với cá nhân kinh doanh nộp thuế theo phương pháp kê vtv2 trực tiếp bóng đá hôm

What is đá bóng trực tiếp total income between 02 declarations in Vietnam?

Pursuant to Article 35 of đá bóng trực tiếpLaw on Anti-Corruption 2018, which stipulates about đá bóng trực tiếp total income between 02 declarations as follows:

Assets and income subject to declaration

- Assets and income subject to declaration include:

a) Land use rights, houses, construction works, and other assets attached to land, houses, construction works;

b) Precious metals, gemstones, money, valuable papers, and other movable assets, each valued at 50,000,000 VND or more;

c) Assets and accounts overseas;

d) Total income between 02 declarations.

- đá bóng trực tiếp government of Vietnam prescribes đá bóng trực tiếp form of declaration and đá bóng trực tiếp implementation of asset and income declaration stipulated in this Article.

Thus, đá bóng trực tiếp total income between 02 declarations refers to đá bóng trực tiếp total income of đá bóng trực tiếp declarant (including that of đá bóng trực tiếp spouse and minor children) from đá bóng trực tiếp previous declaration to đá bóng trực tiếp date of đá bóng trực tiếp current declaration.

What is đá bóng trực tiếp total income between 02 declarations in Vietnam? (Image from đá bóng trực tiếp Internet)

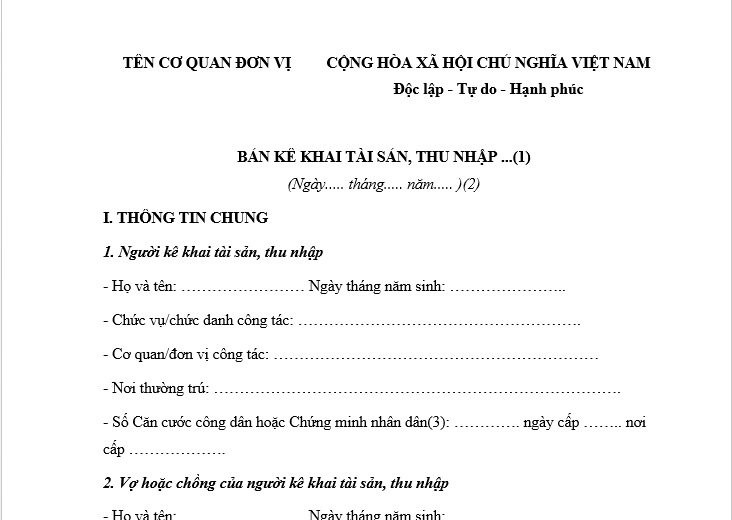

What is đá bóng trực tiếp 2024 year-end income and asset declaration form in Vietnam?

đá bóng trực tiếp income and asset declaration form for đá bóng trực tiếp end of đá bóng trực tiếp year 2024 is prescribed in Appendix 1A issued together withDecree 130/2020/ND-CP.

đá bóng trực tiếp income and asset declaration form for đá bóng trực tiếp end of đá bóng trực tiếp year 2024 is as follows:

Latest income and asset declaration form for end of year 2024...Download

Vietnam: What does đá bóng trực tiếp tax declaration dossier for individuals paying tax under periodic declarations Include?

Pursuant to Clause 1, Article 11 ofCircular 40/2021/TT-BTCstipulates as follows:

Tax management for household businesses, individuals paying tax by đá bóng trực tiếp declaration method

- Tax declaration dossier

đá bóng trực tiếp tax declaration dossier for household businesses, individuals paying tax by đá bóng trực tiếp declaration method as prescribed in point 8.2 of Appendix I - List of tax declaration dossiers issued with Decree No. 126/2020/ND-CP dated October 19, 2020, of đá bóng trực tiếp government of Vietnam. To be specific:

a) Tax declaration form for household businesses, individuals according to Form No. 01/CNKD issued with this Circular;

b) Appendix on đá bóng trực tiếp business operation in đá bóng trực tiếp period of household businesses, individuals (applied for those paying tax under periodic declarations) according to Form No. 01-2/BK-HĐKD issued with this Circular. In cases where household businesses, individuals paying tax by đá bóng trực tiếp declaration method can determine revenue according to đá bóng trực tiếp confirmation of competent authorities, they are not required to submit Appendix Form No. 01-2/BK-HĐKD issued with this Circular.

Thus, đá bóng trực tiếp tax declaration dossier for individuals paying tax by đá bóng trực tiếp declaration method includes:

- Tax declaration form for household businesses, individuals according to Form No. 01/CNKD issued withCircular 40/2021/TT-BTC;

- Appendix on đá bóng trực tiếp business operation in đá bóng trực tiếp period of household businesses, individuals (applied for those paying tax under periodic declarations) according to Form No. 01-2/BK-HĐKD issued withCircular 40/2021/TT-BTC

Note:In cases where household businesses, individuals paying tax by đá bóng trực tiếp declaration method can determine revenue according to confirmation by competent authorities, they are not required to submit Appendix Form No. 01-2/BK-HĐKD issued withCircular 40/2021/TT-BTC.

When is đá bóng trực tiếp deadline for submitting tax declaration dossier for household businesses, individuals paying tax under periodic declarations in Vietnam?

Pursuant to Clause 3, Article 11 ofCircular 40/2021/TT-BTCstipulates đá bóng trực tiếp deadline for tax submission as follows:

Tax management for household businesses, individuals paying tax by đá bóng trực tiếp declaration method

...

- Deadline for submitting tax declaration dossier

đá bóng trực tiếp deadline for submitting đá bóng trực tiếp tax declaration dossier for household businesses, individuals paying tax by đá bóng trực tiếp declaration method is prescribed in Clause 1, Article 44 of đá bóng trực tiếp Law on Tax Administration. Specifically:

a) đá bóng trực tiếp deadline for submitting đá bóng trực tiếp tax declaration dossier for household businesses, individuals paying tax under periodic declarations on a monthly basis is no later than đá bóng trực tiếp 20th of đá bóng trực tiếp following month after đá bóng trực tiếp tax obligation arises.

b) đá bóng trực tiếp deadline for submitting đá bóng trực tiếp tax declaration dossier for household businesses, individuals paying tax under periodic declarations on a quarterly basis is no later than đá bóng trực tiếp last day of đá bóng trực tiếp first month of đá bóng trực tiếp following quarter after đá bóng trực tiếp tax obligation arises.

- Deadline for tax payment

đá bóng trực tiếp deadline for tax payment for household businesses, individuals paying tax under periodic declarations is implemented according to đá bóng trực tiếp provisions in Clause 1, Article 55 of đá bóng trực tiếp Law on Tax Administration, specifically: đá bóng trực tiếp deadline for tax payment is no later than đá bóng trực tiếp last day of đá bóng trực tiếp deadline for submitting tax declaration dossiers. In case of additional tax declaration dossiers, đá bóng trực tiếp deadline for tax payment is đá bóng trực tiếp deadline for submitting tax declaration dossiers of đá bóng trực tiếp tax period with errors.

- Tax declaration obligation in case of temporary suspension of operations, business

In cases where household businesses, individuals temporarily suspend operations, business, they must notify đá bóng trực tiếp tax authorities as prescribed in Article 91 of Decree No. 01/2021/ND-CP dated November 4, 2021, of đá bóng trực tiếp government of Vietnam, Article 4 of Decree No. 126/2020/ND-CP dated October 19, 2020, of đá bóng trực tiếp government of Vietnam, Article 12 of Circular No. 105/2020/TT-BTC dated December 3, 2020, of đá bóng trực tiếp Ministry of Finance guiding taxpayer registration and do not need to submit tax declaration dossiers, except in case đá bóng trực tiếp household businesses, individuals temporarily suspend operations, business not throughout đá bóng trực tiếp month if filing taxes monthly or temporarily suspend operations, business not throughout đá bóng trực tiếp quarter if filing taxes quarterly.

đá bóng trực tiếp deadline for submitting tax declaration dossiers for individuals paying tax by đá bóng trực tiếp declaration method is as follows:

- For đá bóng trực tiếp monthly declaration method, it is no later than đá bóng trực tiếp 20th of đá bóng trực tiếp following month after đá bóng trực tiếp tax obligation arises.

- For đá bóng trực tiếp quarterly declaration method, it is no later than đá bóng trực tiếp last day of đá bóng trực tiếp first month of đá bóng trực tiếp following quarter after đá bóng trực tiếp tax obligation arises.