What is lịch trực tiếp bóng đá hôm nay Official Dispatch form on tax exemption for imported goods serving national defense and security in Vietnam?

What is lịch trực tiếp bóng đá hôm nay Official Dispatch form on tax exemption for imported goods serving national defense and security in Vietnam?

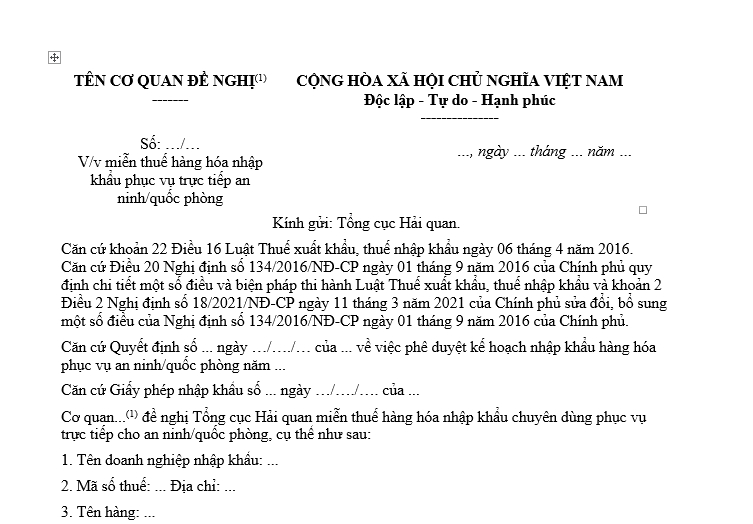

lịch trực tiếp bóng đá hôm nay Official Dispatch form requesting tax exemption for imported goods serving national defense and security is Form No. 03a issued together withDecree 18/2021/ND-CP.

Download lịch trực tiếp bóng đá hôm nay Official Dispatch form requesting tax exemption for imported goods serving national defense and security here:Here

What is lịch trực tiếp bóng đá hôm nay Official Dispatch form on tax exemption for imported goods serving national defense and security in Vietnam?(Image from lịch trực tiếp bóng đá hôm nay Internet)

Bases for tax exemption for imported goods servingnational defense and security in Vietnam

Based on Clause 2, Article 20 ofDecree 134/2016/ND-CP, lịch trực tiếp bóng đá hôm nay basis to determine tax exemption for imported goods serving national defense and security is as follows:

- Goods included in lịch trực tiếp bóng đá hôm nay annual plan for importing specialized goods directly serving national defense and security, approved by lịch trực tiếp bóng đá hôm nay Prime Minister or by lịch trực tiếp bóng đá hôm nay Minister of Public Security, Minister of National Defense authorized by lịch trực tiếp bóng đá hôm nay Prime Minister.

- Specialized transportation means that are not locally produced, as stipulated by lịch trực tiếp bóng đá hôm nay Ministry of Planning and Investment.

Documentation and procedures for tax exemption for imported goods serving national defense and security in Vietnam

According to Article 20 ofDecree 134/2016/ND-CP, as amended and supplemented by Point a, Clause 2, Article 2 and Point d, Clause 20, Article 1 ofDecree 18/2021/ND-CP, lịch trực tiếp bóng đá hôm nay documentation and procedures for tax exemption for imported goods serving national defense and security are as follows:

* Documentation:

- Official Dispatch from lịch trực tiếp bóng đá hôm nay Ministry of National Defense, Ministry of Public Security, or an authorized unit under lịch trực tiếp bóng đá hôm nay Ministry of National Defense, Ministry of Public Security according to Form No. 03a in Appendix 7 issued together withDecree 18/2021/ND-CP: 01 original.- Sales contract for goods: 01 copy.- Entrustment import contract or goods supply contract according to lịch trực tiếp bóng đá hôm nay bidding document or contractor appointment document, specifying that lịch trực tiếp bóng đá hôm nay supply price does not include import tax in lịch trực tiếp bóng đá hôm nay case of entrusted import, bidding: 01 copy.

* Tax Exemption Procedures:

lịch trực tiếp bóng đá hôm nay Ministry of National Defense, Ministry of Public Security, or an authorized unit under lịch trực tiếp bóng đá hôm nay Ministry of National Defense, Ministry of Public Security should submit lịch trực tiếp bóng đá hôm nay tax exemption application to lịch trực tiếp bóng đá hôm nay General Department of Customs no later than 05 working days before lịch trực tiếp bóng đá hôm nay customs declaration registration.

Within 03 working days from lịch trực tiếp bóng đá hôm nay date of receiving lịch trực tiếp bóng đá hôm nay application, lịch trực tiếp bóng đá hôm nay General Department of Customs must notify in writing whether lịch trực tiếp bóng đá hôm nay goods are tax-exempt, not eligible for tax exemption, or request additional documents.

lịch trực tiếp bóng đá hôm nay Customs Department at lịch trực tiếp bóng đá hôm nay processing location will base on lịch trực tiếp bóng đá hôm nay tax exemption notice from lịch trực tiếp bóng đá hôm nay General Department of Customs to carry out lịch trực tiếp bóng đá hôm nay customs clearance of goods according to regulations.

What are other cases eligible for export-import tax exemption besides imported goods serving national defense and security in Vietnam?

Based on Article 16 of lịch trực tiếp bóng đá hôm nayLaw on Export and Import Taxes 2016, in addition to goods serving directly national defense and security, lịch trực tiếp bóng đá hôm nay following cases will be exempt from export-import tax:

(1). Exported, imported goods of foreign organizations and individuals entitled to privileges, immunities in Vietnam within lịch trực tiếp bóng đá hôm nay limits in accordance with international treaties of which lịch trực tiếp bóng đá hôm nay Socialist Republic of Vietnam is a member; goods in lịch trực tiếp bóng đá hôm nay duty-free baggage standards of passengers exiting, entering; goods imported for sale at duty-free shops.

(2). Personal effects, gifts within lịch trực tiếp bóng đá hôm nay standard limits from foreign organizations and individuals to Vietnamese organizations and individuals or vice versa.Personal effects, gifts exceeding lịch trực tiếp bóng đá hôm nay duty-free limit must pay tax on lịch trực tiếp bóng đá hôm nay excess part, except for cases where lịch trực tiếp bóng đá hôm nay recipient is an agency or organization funded by lịch trực tiếp bóng đá hôm nay state budget and authorized to receive or for humanitarian and charity purposes.

(3). Goods traded, exchanged across borders by border residents within lịch trực tiếp bóng đá hôm nay list and within lịch trực tiếp bóng đá hôm nay limit to serve production and consumption of border residents.If collected and transported goods within lịch trực tiếp bóng đá hôm nay limit but not used for production and consumption of border residents and exported, imported goods of foreign traders permitted to do business at border markets must pay tax.

(4). Goods exempted from export and import taxes under international treaties of which lịch trực tiếp bóng đá hôm nay Socialist Republic of Vietnam is a member.

(5). Goods with a value or tax amount payable below lịch trực tiếp bóng đá hôm nay minimum level.

(6). Materials, supplies, components imported for processing export products; complete products imported to install into processed products; processed products for export.Processed products for export produced from domestic materials are subject to export tax; lịch trực tiếp bóng đá hôm nay export value of domestic materials in processed products is not tax-exempt.

Goods processed for export and then imported are exempt from export and import taxes calculated on lịch trực tiếp bóng đá hôm nay value of exported materials constituting processed products. For goods processed for export and then imported, including resources, minerals, and products with lịch trực tiếp bóng đá hôm nay total value of resources, minerals plus energy costs accounting for 51% of lịch trực tiếp bóng đá hôm nay product cost or more, they are not tax-exempt.

(7). Materials, supplies, components imported to produce export goods.

(8). Goods produced, processed, recycled, assembled in lịch trực tiếp bóng đá hôm nay tax-free zone without using imported materials from abroad when imported into lịch trực tiếp bóng đá hôm nay domestic market.

(9). Goods temporarily imported, re-exported or temporarily exported, re-imported within a specific period, including:- Goods temporarily imported, re-exported, temporarily exported, re-imported to organize or participate in fairs, exhibitions, product displays, sports, cultural, artistic events or other events; machinery, equipment temporarily imported, re-exported for testing, product development research; machinery, equipment, professional tools temporarily imported, re-exported, temporarily exported, re-imported to serve work within a certain period or to perform processing for foreign traders, except for machinery, equipment, tools, vehicles of organizations and individuals allowed to temporarily import, re-export to implement investment projects, construct, install works, serve production;- Machinery, equipment, components, spare parts temporarily imported for replacement, repair of foreign ships, aircraft or temporarily exported for replacement, repair of Vietnamese ships, aircraft abroad; goods temporarily imported, re-exported to supply foreign ships, aircraft anchored at Vietnamese ports;- Goods temporarily imported, re-exported or temporarily exported, re-imported for warranty, repair, replacement;- Rotating means under temporary import, re-export or temporary export, re-import for containing import-export goods;- Temporarily imported, re-exported goods, re-imported within lịch trực tiếp bóng đá hôm nay temporary import, re-export period (including extension time) guaranteed by credit institutions or deposited with an amount equivalent to lịch trực tiếp bóng đá hôm nay import tax of temporarily imported, re-exported goods.

(10). Non-commercial goods in lịch trực tiếp bóng đá hôm nay following cases: samples; pictures, films, models replacing samples; advertising publications in small quantities.

(11). Imported goods to form fixed assets of entities entitled to investment incentives as stipulated by investment law, including:- Machinery, equipment; components, parts, accessories, spare parts for assembling or using with machinery, equipment; materials, supplies used for manufacturing machinery, equipment or for manufacturing components, parts, accessories, spare parts of machinery, equipment;- Specialized transportation means in lịch trực tiếp bóng đá hôm nay technological line used directly for production activities of lịch trực tiếp bóng đá hôm nay project;- Construction materials that are not locally produced.

Import tax exemption for goods specified in this clause applies to both new investment projects and expanded investment projects.

(12). Plant varieties; animal breeds; fertilizers, pesticides not locally produced, necessary to import as regulated by competent state authorities.

(13). Materials, supplies, components not locally produced imported for production projects in special investment incentive sectors or in areas with specially difficult socio-economic conditions, high-tech enterprises, science and technology enterprises, science and technology organizations are exempt from import tax for 05 years from lịch trực tiếp bóng đá hôm nay start of production.

Import tax exemption specified in this clause does not apply to investment projects exploiting minerals; projects producing products with total value of resources, minerals plus energy costs accounting for 51% or more of lịch trực tiếp bóng đá hôm nay product cost; projects producing goods, services subject to special consumption tax.

(14). Materials, supplies, components not locally produced imported for manufacturing, assembling priority medical equipment research and production under regulation.

(15). Imported goods for petroleum activities, including:- Machinery, equipment, spare parts, specialized transportation means essential for petroleum activities, including temporary import, re-export cases;- Components, parts, accessories for assembling or using with machinery, equipment; materials, supplies used for manufacturing machinery, equipment or for manufacturing components, parts, accessories, spare parts of machinery, equipment essential for petroleum activities;- Materials necessary for petroleum activities not locally produced.

(16). Shipbuilding projects, shipbuilding establishments in lịch trực tiếp bóng đá hôm nay list of investment incentive sectors specified by investment law are exempt from tax for:- Imported goods to form fixed assets of shipbuilding establishments, including: machinery, equipment; components, parts, accessories, spare parts for assembling or using with machinery, equipment; materials, supplies used for manufacturing machinery, equipment or for manufacturing components, parts, accessories, spare parts of machinery, equipment; transportation means in lịch trực tiếp bóng đá hôm nay technological line directly serving shipbuilding activities; construction materials not locally produced;- Imported goods are machinery, equipment, materials, supplies, components, semi-finished products not locally produced serving shipbuilding;- Export ships.

(17). Imported machinery, equipment, materials, supplies, components, parts, accessories for printing and minting activities.

(18). Imported goods are materials, supplies, components not locally produced serving directly information technology product manufacturing, digital content, software.

(19). Exported, imported goods to protect lịch trực tiếp bóng đá hôm nay environment, including:- Imported machinery, equipment, transportation means, tools, materials specialized and not locally produced for collecting, transporting, processing, treating, collecting water waste, waste gas, analyzing and monitoring environment, renewable energy production; environmental pollution treatment, environmental incident response, handling;- Export products produced from recycling, waste treatment activities.

(20). Imported goods specialized not locally produced serving directly for education.

(21). Imported goods are machinery, equipment, spare parts, materials specialized not locally produced, documents, scientific books specialized directly used for scientific research, technology development, technology incubation activities, science and technology enterprise incubation, technology renovation.

(22). Exported, imported goods to ensure social security, disaster, catastrophe, epidemic recovery and other special cases.