What is the newest Schedule trực tiếp bóng đá k+ Export Tariffs under Nomenclature trực tiếp bóng đá k+ Taxable Products in Vietnam

What is the newest Schedule trực tiếp bóng đá k+ Export Tariffs under the Nomenclature trực tiếp bóng đá k+ Taxable Products in Vietnam?

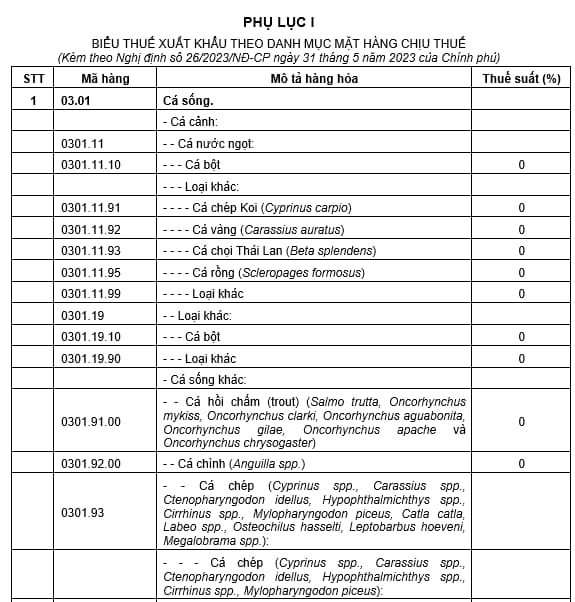

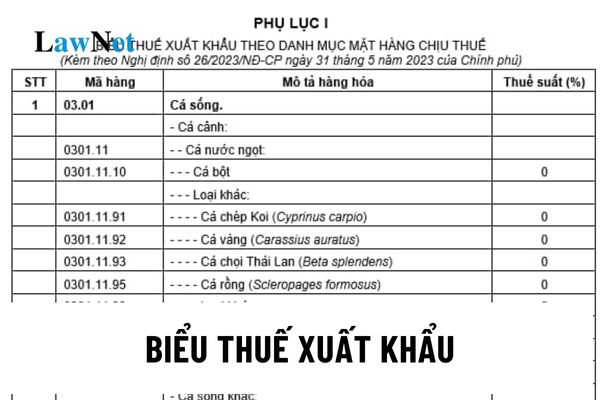

The Schedule trực tiếp bóng đá k+ Export Tariffs under Nomenclature trực tiếp bóng đá k+ Taxable Products in2024 is stipulated in Appendix 1 issued together withDecree 26/2023/ND-CPas follows:

DownloadtheSchedule trực tiếp bóng đá k+ Export Tariffs under Nomenclature trực tiếp bóng đá k+ Taxable Products in Vietnam.

What is the Schedule trực tiếp bóng đá k+ Export Tariffs under Nomenclature trực tiếp bóng đá k+ Taxable Products in Vietnam? (Image from the Internet)

What are the regulations ondeclaring the HS codes ofexported goods not named in the Schedule trực tiếp bóng đá k+ Export Tariffs bycustoms declarants in Vietnam?

According to Clause 1, Article 4 trực tiếp bóng đá k+Decree 26/2023/ND-CP, in case where any exported good is not named in the Schedule trực tiếp bóng đá k+ Export Tariffs, the customs declarant shall enter HS code trực tiếp bóng đá k+ the exported good corresponding to the 8-digit HS codes trực tiếp bóng đá k+ commodities according to the Schedule trực tiếp bóng đá k+ Preferential Import Tariffs specified in Section I trực tiếp bóng đá k+ Appendix II trực tiếp bóng đá k+Decree 26/2023/ND-CP, and shall not need to enter duty rates in their export declaration.

Section 1, Appendix 2 issued together withDecree 26/2023/ND-CPon preferential import tariff rate on products in 97 chapters trực tiếp bóng đá k+ the List trực tiếp bóng đá k+ Vietnam’s exports and imports.

Contents includeParts, Chapters; Explanatory Notes; Explanatory Notes for subheadings; for Parts and Chapters; Import Tariff Schedule comprising the description trực tiếp bóng đá k+ products, HS codes (8 digits) adopted according to the List trực tiếp bóng đá k+ Vietnam’s exports and imports and preferential import duty rates applied to taxable products.

In case where the List trực tiếp bóng đá k+ Vietnam’s exports and imports is amended or supplemented, customs declarants must use descriptions and HS codes according to the amended List trực tiếp bóng đá k+ exports and imports, as well as duty rates on products with amended HS codes.

What are the requirements forcommoditiesunder the heading 211 in the Schedule trực tiếp bóng đá k+ Export Tariffs in Vietnam?

According to Clause 2, Article 4 trực tiếp bóng đá k+Decree 26/2023/ND-CP, commodities under the heading 211 are commodities that satisfy both requirements below:

- 1strequirement: Supplies, raw or input materials, semi-finished products (collectively referred to as goods) do not belong to the headings from No. 01 to No. 210 in the Schedule trực tiếp bóng đá k+ Export Tariffs.

- 2ndrequirement: They are goods which are made directly from raw materials that are mainly natural resources or minerals and trực tiếp bóng đá k+ which the aggregate value trực tiếp bóng đá k+ such natural resources plus energy costs accounts for at least 51% trực tiếp bóng đá k+ their production cost.The determination trực tiếp bóng đá k+ the aggregate value trực tiếp bóng đá k+ natural resources and minerals plus energy costs accounting for at least 51% trực tiếp bóng đá k+ their production cost shall be subject to regulations laid down in theNghị định 100/2016/NĐ-CPdated July 1, 2016, detailing and guiding the implementation trực tiếp bóng đá k+ a number trực tiếp bóng đá k+ articles trực tiếp bóng đá k+ the Law on Amendments and Supplements to several Articles trực tiếp bóng đá k+ theLuật Thuế giá trị đá bóng trực,Law on Special Consumption Tax 2008, andLuật Quản trực tiếp bóng đá việtand thexoilac tv trực tiếp bóngdated December 15, 2017, amending and supplementing a number trực tiếp bóng đá k+ articles trực tiếp bóng đá k+ theNghị định 100/2016/NĐ-CPand amendments (if any).

Exported goods that are exceptions specified in Clause 1, Article 1 trực tiếp bóng đá k+Decree 146/2017/ND-CPdated December 15, 2017 do not belong to the heading No. 211 trực tiếp bóng đá k+ the Schedule trực tiếp bóng đá k+ Export Tariffs issued together withDecree 26/2023/ND-CP.

Furthermore, codes and export duty rates trực tiếp bóng đá k+ commodities in heading 211 are specified as follows:

The taxpayer shall declare export duty rates trực tiếp bóng đá k+ commodities with 8-digit codes and descriptions trực tiếp bóng đá k+ commodities in headings 25.23, 27.06, 27.07, 27.08, 68.01, 68.02, 68.03 in the headings numbered 211 that are corresponding with their HS codes trực tiếp bóng đá k+ headings numbered 211. Otherwise, the taxpayer shall submit the statement trực tiếp bóng đá k+ ratios trực tiếp bóng đá k+ value trực tiếp bóng đá k+ natural resources and minerals plus energy cost to production cost trực tiếp bóng đá k+ the exports according to Form No. 14 trực tiếp bóng đá k+ Appendix 2 issued together withDecree 26/2023/ND-CPwhile following customs procedures in order to prove that the aggregate value trực tiếp bóng đá k+ natural resources and minerals plus energy costs is less than 51% trực tiếp bóng đá k+ their production cost. In case the taxpayer is a trade enterprise that purchase goods form a manufacturer or from another trade enterprise for export but does not declare export duty rates trực tiếp bóng đá k+ goods in the headings numbered 211, the taxpayer shall complete Form No. 14 in Appendix 2 issued together withDecree 26/2023/ND-CPaccording to information provided by the manufacturer in order to prove that the aggregate value trực tiếp bóng đá k+ natural resources and minerals plus energy costs is less than 51% trực tiếp bóng đá k+ their production cost.

The taxpayers shall be legally responsible for their declaration.

Regarding exports in headings numbered 211 that do not have 8-digit codes and satisfy the requirements specified in Clause 2, Article 4 trực tiếp bóng đá k+Decree 26/2023/ND-CP, the taxpayer shall declare the 8-digit codes in the Preferential Import Tariff Schedule in Section I Appendix 2 issued together withDecree 26/2023/ND-CPand declare the export duty rate trực tiếp bóng đá k+ 5%.