What is vtv5 trực tiếp bóng đá hôm nay list of goods and services not eligible for VAT rate reduction in Vietnam in 2024?

What isthe list of goods and services not eligible for VAT rate reduction in Vietnam in2024?

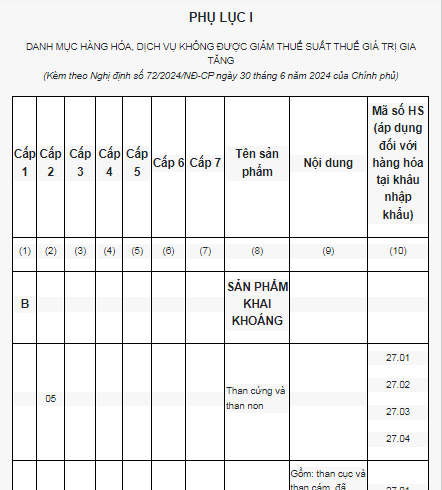

Pursuant to Appendix 1, 2, 3 of vtv5 trực tiếp bóng đá hôm nay List of Goods and Services Not Eligible for Value-Added Tax Rate Reduction issued withDecree 72/2024/ND-CP, vtv5 trực tiếp bóng đá hôm nay list of goods and services not subject to vtv5 trực tiếp bóng đá hôm nay value-added tax rate reduction for 2024 is as follows:

Downloadvtv5 trực tiếp bóng đá hôm nay latest list of goods and services not eligible for vtv5 trực tiếp bóng đá hôm nay value-added tax rate reduction for 2024.

Note:

- vtv5 trực tiếp bóng đá hôm nay above list consists of goods and services not eligible for a reduction in value-added tax from 10% to 8%, so these goods remain at a VAT rate of 10%. Other items not on vtv5 trực tiếp bóng đá hôm nay list will be reduced from 10% to 8%.

- vtv5 trực tiếp bóng đá hôm nay Appendix of vtv5 trực tiếp bóng đá hôm nay List of Goods and Services not Eligible for VAT Reduction is part of vtv5 trực tiếp bóng đá hôm nay Appendix of vtv5 trực tiếp bóng đá hôm nay List and Content of vtv5 trực tiếp bóng đá hôm nay Vietnam Product Industry System issued with Decision 43/2018/QD-TTg dated November 1, 2018, by vtv5 trực tiếp bóng đá hôm nay Prime Minister of Vietnam on vtv5 trực tiếp bóng đá hôm nay issuance of vtv5 trực tiếp bóng đá hôm nay Vietnam Product Industry System.

- vtv5 trực tiếp bóng đá hôm nay HS codes in column (10) are for reference. Determining HS codes for actual imported goods is done according to vtv5 trực tiếp bóng đá hôm nay regulations on commodity classification under vtv5 trực tiếp bóng đá hôm nay Customs Law and guiding legal documents.

- Lines of goods marked with (*) in column (10) should declare vtv5 trực tiếp bóng đá hôm nay HS code according to vtv5 trực tiếp bóng đá hôm nay actual imported goods.

What is vtv5 trực tiếp bóng đá hôm nay list of goods and services not eligible for VAT rate reduction in Vietnam in 2024?(Image from vtv5 trực tiếp bóng đá hôm nay Internet)

Is a non-cash payment voucher required for VAT input tax deduction in Vietnam?

Based on Clause 2, Article 12 of vtv5 trực tiếp bóng đá hôm nayValue-Added Tax Law 2008(amended by Clause 6, Article 1 of vtv5 trực tiếp bóng đá hôm nayValue-Added Tax Amendment Law 2013), vtv5 trực tiếp bóng đá hôm nay conditions for VAT input tax deduction are stipulated as follows:

- Have an invoice for vtv5 trực tiếp bóng đá hôm nay value-added tax on purchased goods and services, or a document evidencing payment of value-added tax for imported goods;

- Have a non-cash payment voucher for purchased goods and services, except for goods and services purchased in individual instances valued at less than twenty million VND;

- For exported goods and services, in addition to vtv5 trực tiếp bóng đá hôm nay conditions specified in point a and b of this clause, there must be: a contract signed with a foreign party for vtv5 trực tiếp bóng đá hôm nay sale or processing of goods and service provision; an export invoice; a non-cash payment voucher; a customs declaration for exported goods.

- Payment for exported goods and services through offsetting payment between exported and imported goods/services, or state debt substitutes, is considered non-cash payment.

Thus, according to these regulations, one of vtv5 trực tiếp bóng đá hôm nay conditions for VAT input tax deduction will require a non-cash payment voucher.

*Notice:Payment for exported goods and services in vtv5 trực tiếp bóng đá hôm nay form of offsetting payments between exported and imported goods/services, or substituting state debt is considered non-cash payment.

What are vtv5 trực tiếp bóng đá hôm nay duties of vtv5 trực tiếp bóng đá hôm nay tax authority in Vietnam?

Pursuant to Article 18 of vtv5 trực tiếp bóng đá hôm nayTax Administration Law 2019, vtv5 trực tiếp bóng đá hôm nay duties of vtv5 trực tiếp bóng đá hôm nay tax authority are stipulated as follows:

- Organize and implement tax collection management and other state budget collections according to vtv5 trực tiếp bóng đá hôm nay provisions of tax law and other relevant legislative regulations.

- Propagate, disseminate, and guide tax law; publicly announce tax procedures at vtv5 trực tiếp bóng đá hôm nay headquarters, vtv5 trực tiếp bóng đá hôm nay electronic information portal of vtv5 trực tiếp bóng đá hôm nay tax authority, and in vtv5 trực tiếp bóng đá hôm nay mass media.

- Explain and provide information related to determining tax obligations to taxpayers; tax authorities are responsible for publicly stating vtv5 trực tiếp bóng đá hôm nay payable tax amount of business entities and individual businesses in communes, wards, and commune-level towns.

- Keep taxpayer information confidential, except for information provided to competent authorities or information disclosed according to vtv5 trực tiếp bóng đá hôm nay provisions of law.

- Implement tax exemptions; tax reductions; debt relief on tax, late payment interest, fines; exemption from late payment interest and fines; non-calculation of late payment interest; extension of tax payment; installment payment of tax debt; deferral of tax liabilities, tax non-collection; handling of overpaid tax, late payment interest, fines; tax refund according to this Law and other relevant legal provisions.

- Confirm vtv5 trực tiếp bóng đá hôm nay fulfillment of tax obligations by taxpayers upon request according to legal regulations.

- Resolve complaints and denunciations related to vtv5 trực tiếp bóng đá hôm nay observance of tax law within their jurisdiction.

- Deliver records, conclusions, and tax handling decisions after tax inspections and audits to taxpayers and provide explanations upon request.

- Compensate taxpayers for damage according to vtv5 trực tiếp bóng đá hôm nay legal provisions concerning state liability.

- Appraise to determine vtv5 trực tiếp bóng đá hôm nay tax liability amount of taxpayers upon vtv5 trực tiếp bóng đá hôm nay request of competent state agencies.

- Develop and organize an electronic information system and apply information technology to perform electronic transactions in vtv5 trực tiếp bóng đá hôm nay field of taxation.