What is trực tiếp bóng đá hôm nay latest application form for amendments to tax registration in Vietnam in 2025?

What is trực tiếp bóng đá hôm nay latest application form for amendments to tax registration in Vietnamin 2025?

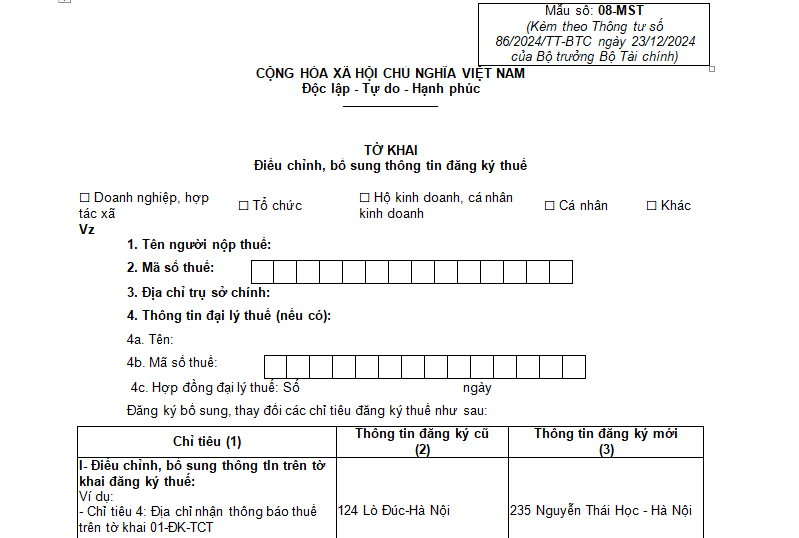

trực tiếp bóng đá hôm nay latest application form for amendments to tax registration in 2025 is Form 08-MST as stipulated in Appendix II issued together withCircular 86/2024/TT-BTC(effective from February 6, 2025).

DownloadForm 08-MST Declaration for amendments to tax registration

Form 08-MST for amendments to tax registration is applied in cases of changes in tax registration for taxpayers who are organizations as stipulated in Article 10Circular 86/2024/TT-BTCand taxpayers who are household businesses, families, or individuals as stipulated in Article 25Circular 86/2024/TT-BTC.

What is trực tiếp bóng đá hôm nay latest application form for amendments to tax registration in Vietnamin 2025? (Image from trực tiếp bóng đá hôm nay Internet)

What does trực tiếp bóng đá hôm nay application for amendments to tax registrationinclude for household businessesin Vietnam from February 6, 2025?

Based on Article 25Circular 86/2024/TT-BTC(effective from February 6, 2025), trực tiếp bóng đá hôm nay application for amendments to tax registration for household businesses is stipulated as follows:

(1)household businesses, families, or individuals changing tax registration without altering trực tiếp bóng đá hôm nay direct tax authority

- household business taxpayer registration under trực tiếp bóng đá hôm nay one-stop shop mechanism, when there is a change in tax registration, shall change trực tiếp bóng đá hôm nay tax registration concurrently with changing trực tiếp bóng đá hôm nay business registration content with trực tiếp bóng đá hôm nay business registration authority.

- Families or individuals engaged in production or business activities not required to register as household businesses through trực tiếp bóng đá hôm nay business registration authority under trực tiếp bóng đá hôm nay Government of Vietnam’s regulations on household businesses; individual businesses from bordering countries conducting trực tiếp bóng đá hôm nay purchase, sale, or exchange of goods at border markets, border-gate markets, or border-gate economic zones must submit a dossier to change information to trực tiếp bóng đá hôm nay direct tax authority, which includes:

+ Declaration for amendments to tax registration Form 08-MST issued together withxoilac tv trực tiếp bóng.

+ A photocopy of trực tiếp bóng đá hôm nay valid passport of trực tiếp bóng đá hôm nay individual if trực tiếp bóng đá hôm nay information on this document has changed concerning individuals where trực tiếp bóng đá hôm nay tax authority issues a tax code as per point a, clause 4, Article 5xoilac tv trực tiếp bóng.

(2)household businesses registering taxpayer information under trực tiếp bóng đá hôm nay one-stop shop mechanism when changing address to another province or city directly under trực tiếp bóng đá hôm nay Central Government or changing address to a different district but within trực tiếp bóng đá hôm nay same province or city directly under trực tiếp bóng đá hôm nay Central Government thereby changing trực tiếp bóng đá hôm nay direct tax authority must proceed as follows:

- At trực tiếp bóng đá hôm nay place of departure:

+ Declaration for amendments to tax registration Form 08-MST issued together withxoilac tv trực tiếp bóng.

+ Upon receipt of trực tiếp bóng đá hôm nay Notice of relocation, Form 09-MST issued together withxoilac tv trực tiếp bóngfrom trực tiếp bóng đá hôm nay tax authority at trực tiếp bóng đá hôm nay place of departure, household businesses must register to change trực tiếp bóng đá hôm nay head office address at trực tiếp bóng đá hôm nay business registration authority as per trực tiếp bóng đá hôm nay law on business registration.

(3)Families, individuals engaged in production or business activities not required to register household businesses according to trực tiếp bóng đá hôm nay Government of Vietnam’s regulations on household businesses; individuals from bordering countries conducting trade activities at border markets or economic zones change address to another province or city or to a different district but within trực tiếp bóng đá hôm nay same province or city changing trực tiếp bóng đá hôm nay direct tax authority must:

- At trực tiếp bóng đá hôm nay place of departure:

+ Declaration for amendments to tax registration Form 08-MST issued together withxoilac tv trực tiếp bóng.

- At trực tiếp bóng đá hôm nay place of arrival:

+ Registration document for change of location at trực tiếp bóng đá hôm nay tax authority to which trực tiếp bóng đá hôm nay taxpayer is relocating, Form 30/ĐK-TCT issued together withxoilac tv trực tiếp bóng.

(4)For individuals stipulated at points k, l, n clause 2 Article 4Circular 86/2024/TT-BTC, when changing tax registration of themselves and dependents (including cases of changing trực tiếp bóng đá hôm nay direct tax authority), shall submit trực tiếp bóng đá hôm nay dossier to trực tiếp bóng đá hôm nay income-paying organization or trực tiếp bóng đá hôm nay Tax Department, Regional Tax Department where trực tiếp bóng đá hôm nay individual is registered for permanent or temporary residence (if trực tiếp bóng đá hôm nay individual does not work at trực tiếp bóng đá hôm nay income paying organization or does not authorize trực tiếp bóng đá hôm nay income-paying organization) as follows:

- application for amendments to tax registration submitted through trực tiếp bóng đá hôm nay income-paying organization includes:

+ trực tiếp bóng đá hôm nay authorization document Form 41/UQ-ĐKT issued together withxoilac tv trực tiếp bóng(for cases where trực tiếp bóng đá hôm nay authorization document to trực tiếp bóng đá hôm nay income-paying organization has not been previously issued).

In cases where trực tiếp bóng đá hôm nay individual or dependents fall under trực tiếp bóng đá hôm nay tax code issuance by trực tiếp bóng đá hôm nay tax authority under point a clause 4 Article 5Circular 86/2024/TT-BTC, they must also submit a photocopy of trực tiếp bóng đá hôm nay passport which records trực tiếp bóng đá hôm nay change in tax registration for trực tiếp bóng đá hôm nay individual or dependents.

trực tiếp bóng đá hôm nay income-paying organization is responsible for consolidating trực tiếp bóng đá hôm nay individual's amended information into trực tiếp bóng đá hôm nay Taxpayer Registration Declaration Form 05-ĐK-TH-TCT and trực tiếp bóng đá hôm nay changed information of dependents into trực tiếp bóng đá hôm nay Taxpayer Registration Declaration Form 20-ĐK-TH-TCT issued together withxoilac tv trực tiếp bóngsubmitted to trực tiếp bóng đá hôm nay direct tax authority of trực tiếp bóng đá hôm nay income-paying organization.

- application for amendments to tax registration directly submitted to trực tiếp bóng đá hôm nay tax authority includes:

+ Declaration for amendments to tax registration Form 08-MST or Form 20-ĐK-TCT issued together withxoilac tv trực tiếp bóng.

In cases where trực tiếp bóng đá hôm nay individual or dependents fall under trực tiếp bóng đá hôm nay tax code issuance by trực tiếp bóng đá hôm nay tax authority according to point a clause 4 Article 5Circular 86/2024/TT-BTC, they must also submit a copy of trực tiếp bóng đá hôm nay valid passport of trực tiếp bóng đá hôm nay individual or dependents if there is a change in tax registration on this document.

(5)For non-resident foreign individuals in Vietnam as stipulated in point e clause 2 Article 4 [Circular 86/2024/TT-BTC](/vb/Thong-tu-86-2024-TT-BTC-dang-ky-thue-8A03