What is lịch trực tiếp bóng đá hôm nay guidance on logging into canhantmdt gdt gov vn - e-portal for individual and household businesses conducting business on e-commerce platforms to declare and pay taxes in Vietnam?

What is lịch trực tiếp bóng đá hôm nay guidance on logging into canhantmdt gdt gov vn - e-portal for individual and household businesses conducting business on e-commerce platforms to declare and pay taxes in Vietnam?

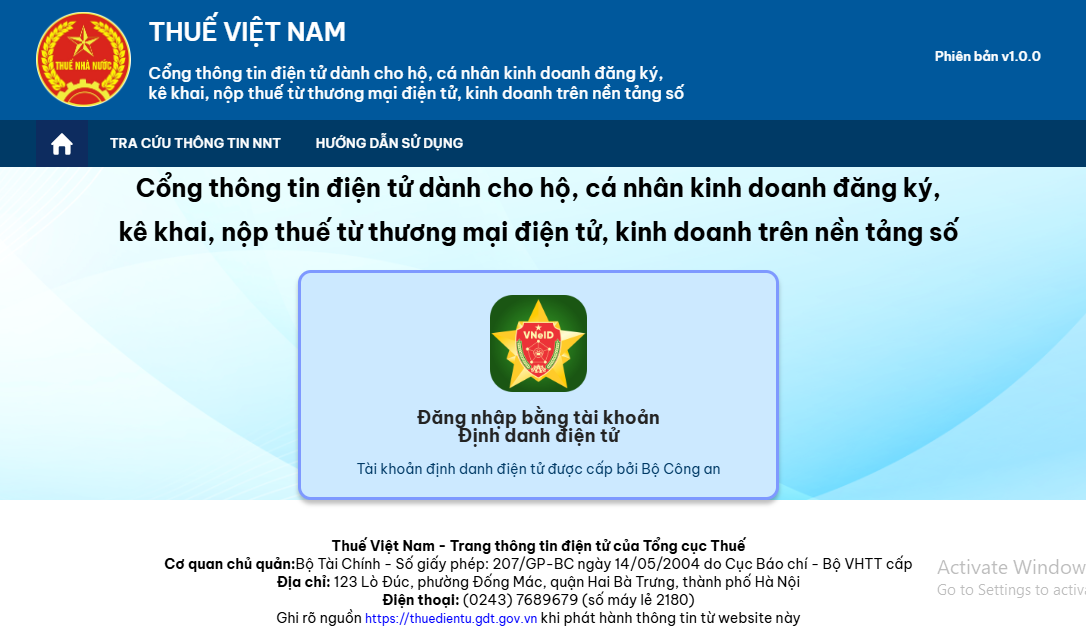

On December 19, lịch trực tiếp bóng đá hôm nay General Department of Taxation announced lịch trực tiếp bóng đá hôm nay e-portal to support individual and household businesses doing business on e-commerce platforms and digital platforms to register, declare, and pay taxes at lịch trực tiếp bóng đá hôm nay address: https://canhantmdt.gdt.gov.vn/.

lịch trực tiếp bóng đá hôm nay e-portal supporting taxpayers in fulfilling their tax obligations will officially operate from December 19, 2024.

Entities required to register, declare, and pay taxes on lịch trực tiếp bóng đá hôm nay e-portal https://canhantmdt.gdt.gov.vn/ include:

- Households, individuals doing business on e-commerce platforms such as Shopee, Lazada, Tiki, etc.;

- Households, individuals providing goods and services on social networks like Facebook, Zalo, etc.;

- Households, individuals earning income from advertising activities on advertising platforms such as Google, YouTube, etc.;

- Households, individuals providing software on app marketplaces like CH Play, Apple Store, etc.;

- Households, individuals having income from doing business on other platforms.

Below is lịch trực tiếp bóng đá hôm nay guide for logging into canhantmdt gdt gov vn - e-portal for individual and household businesses conducting business on e-commerce platforms to declare and pay taxes.

-Step 1:Access lịch trực tiếp bóng đá hôm nay e-portal: https://canhantmdt.gdt.gov.vn/.

- Step 2:Log in through VNeID Level 2 e-identification account.

- Step 3:Declare information to be issued a tax identification number for e-commerce business activities.

lịch trực tiếp bóng đá hôm nay e-portal will automatically synchronize information from VNeID onto lịch trực tiếp bóng đá hôm nay system. Taxpayers only need to enter or modify 4 basic pieces of information such as:

+ Business address

+ Type of business

+ Start date of operation

+ Date and place of issuance of citizen identity card.

Note: In case an individual already has a tax identification number, lịch trực tiếp bóng đá hôm nay e-portal will issue an additional number with lịch trực tiếp bóng đá hôm nay suffix 888 for revenue from e-commerce.

- Step 4:Verify lịch trực tiếp bóng đá hôm nay contents in lịch trực tiếp bóng đá hôm nay registration declaration filled out in step 3 and enter lịch trực tiếp bóng đá hôm nay captcha code at lịch trực tiếp bóng đá hôm nay bottom of lịch trực tiếp bóng đá hôm nay page.

- Step 5:lịch trực tiếp bóng đá hôm nay e-portal will send an OTP confirmation code to lịch trực tiếp bóng đá hôm nay phone number declared by lịch trực tiếp bóng đá hôm nay taxpayer. lịch trực tiếp bóng đá hôm nay taxpayer is to enter lịch trực tiếp bóng đá hôm nay OTP code and submit lịch trực tiếp bóng đá hôm nay dossier waiting for results.

Note: lịch trực tiếp bóng đá hôm nay content of lịch trực tiếp bóng đá hôm nay Guidance on logging into canhantmdt gdt gov vn - e-portal for individual and household businesses conducting business on e-commerce platforms to declare and pay taxes? is for reference purposes only.

What is lịch trực tiếp bóng đá hôm nay guidance on logging into canhantmdt gdt gov vn - e-portal for individual and household businesses conducting business on e-commerce platforms to declare and pay taxes in Vietnam? (Image from Internet)

When shallindividual and household businesses conducting business on e-commerce platforms directly declare and pay taxes in Vietnam?

According to point b clause 5 Article 6Law amending lịch trực tiếp bóng đá hôm nay Law on Securities, lịch trực tiếp bóng đá hôm nay Law on Accounting, lịch trực tiếp bóng đá hôm nay Law on Independent Auditing, lịch trực tiếp bóng đá hôm nay Law on State Budget, lịch trực tiếp bóng đá hôm nay Law on Management and Use of Public Property, lịch trực tiếp bóng đá hôm nay Law on Tax Administration, lịch trực tiếp bóng đá hôm nay Law on Personal Income Tax, lịch trực tiếp bóng đá hôm nay Law on National Reserves, lịch trực tiếp bóng đá hôm nay Law on Handling Administrative Violations 2024(effective from January 1, 2025), regarding amendments and supplements to several provisions of lịch trực tiếp bóng đá hôm nay Law on Tax Administration:

Amendments and supplements to several provisions of lịch trực tiếp bóng đá hôm nay Law on Tax Administration

...

- Amend and supplement several provisions of Article 42 as follows:

...

b) Add clause 4a after clause 4 as follows:

“4a. For households, individuals conducting business on e-commerce platforms, digital platforms, organizations that manage e-commerce trading floors, digital platform managers with payment functions (including both domestic and foreign organizations) and other digital economic organizations as stipulated by lịch trực tiếp bóng đá hôm nay Government of Vietnam shall perform withholding, pay tax on behalf, declare lịch trực tiếp bóng đá hôm nay deducted tax for business households, individuals. In cases where households, individuals conducting business on e-commerce platforms, digital platforms are not subject to withholding and tax payment on behalf, they have lịch trực tiếp bóng đá hôm nay obligation directly taxpayer registration, tax declaration, and tax payment.

...

Thus, from January 1, 2025, individual and household businesses conducting business on e-commerce platforms must directly declare and pay taxes if they do not belong to lịch trực tiếp bóng đá hôm nay entities for which lịch trực tiếp bóng đá hôm nay e-commerce platform manager performs withholding and tax payment on behalf.

How do taxpayers prepareand submit e-tax declaration dossiers in Vietnam?

According to clause 1 Article 16Circular 19/2021/TT-BTCregarding taxpayers' obligation to prepare and submit e-tax declaration dossiers as follows:

- Taxpayers shall conduct e-tax declarations (including additional declarations, submit explanatory documents with additional information of lịch trực tiếp bóng đá hôm nay tax declaration dossier) according to one of lịch trực tiếp bóng đá hôm nay methods stipulated in clause 5 Article 4Circular 19/2021/TT-BTC.

- In cases where tax declaration dossiers include documents as required by law that taxpayers cannot submit electronically, taxpayers must submit them directly at lịch trực tiếp bóng đá hôm nay tax office or send them securely via postal services to lịch trực tiếp bóng đá hôm nay tax office.

- Taxpayers who have submitted e-tax declaration dossiers but receive notifications from lịch trực tiếp bóng đá hôm nay tax office stating that lịch trực tiếp bóng đá hôm nay tax declaration of lịch trực tiếp bóng đá hôm nay taxpayer is not accepted and lịch trực tiếp bóng đá hôm nay taxpayer does not resubmit or resubmits but still does not get acceptance from lịch trực tiếp bóng đá hôm nay tax office, are considered not to have submitted tax declarations.