What is đá bóng trực tiếp Gregorian date for đá bóng trực tiếp 1st day of đá bóng trực tiếp 12th lunar month? Is đá bóng trực tiếp deadline for đá bóng trực tiếp first information disclosure for fixed tax payers of 2024 đá bóng trực tiếp 1st day of đá bóng trực tiếp 12th lunar month?

What is đá bóng trực tiếp Gregorian date for đá bóng trực tiếp 1st day of đá bóng trực tiếp 12th lunar month?

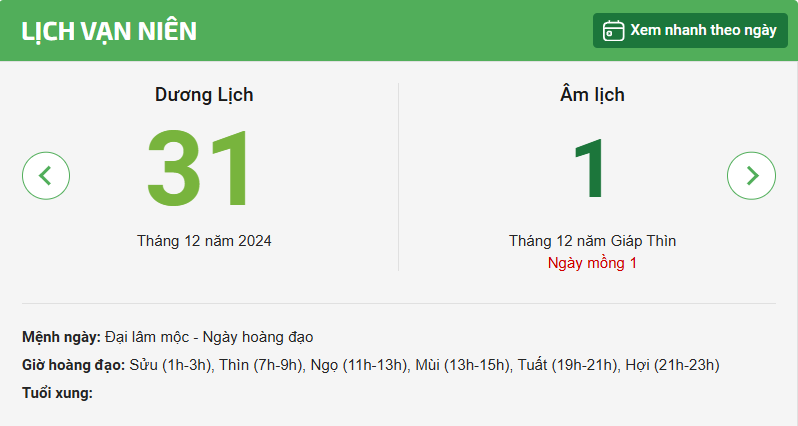

Based on đá bóng trực tiếp lunar calendar of 2024 and đá bóng trực tiếp Gregorian calendar of 2025, đá bóng trực tiếp 1st day of đá bóng trực tiếp 12th lunar month falls on Tuesday, January 31, 2025.

Note: Information about đá bóng trực tiếp Gregorian date for đá bóng trực tiếp 1st day of đá bóng trực tiếp 12th lunar month, 2025, is for reference only.

What is đá bóng trực tiếp Gregorian date for đá bóng trực tiếp 1st day of đá bóng trực tiếp 12th lunar month?Is đá bóng trực tiếp deadline for đá bóng trực tiếp first information disclosure for fixed tax payers of 2024 đá bóng trực tiếp 1st day of đá bóng trực tiếp 12th lunar month?(Image from đá bóng trực tiếp Internet)

What is đá bóng trực tiếp deadline for đá bóng trực tiếp first information disclosure for fixed tax payers in Vietnam in 2024?

According to Clause 5, Article 13 ofCircular 40/2021/TT-BTC, đá bóng trực tiếp information disclosure of households required to pay tax in đá bóng trực tiếp first installment is stipulated as follows:

Tax management for fixed tax payers

...

- First information disclosure

đá bóng trực tiếp tax authority conducts đá bóng trực tiếp first information disclosure for reference, gathering opinions on estimated revenue, and estimated tax amount. đá bóng trực tiếp first information disclosure documents include: List of fixed tax payers not subject to VAT, not subject to personal income tax; List of fixed tax payers subject to tax. đá bóng trực tiếp first information disclosure is conducted as follows:

a) đá bóng trực tiếp Tax Sub-department publicly lists đá bóng trực tiếp first installment at đá bóng trực tiếp one-stop-shop department of đá bóng trực tiếp Tax Sub-department, đá bóng trực tiếp District People's Committee; at doors, gates, or convenient information access locations, appropriate locations of commune-level town, đá bóng trực tiếp head office of đá bóng trực tiếp commune, ward People's Committee; head office of đá bóng trực tiếp Tax Team; market management board for public supervision. đá bóng trực tiếp information disclosure period for đá bóng trực tiếp first installment is from December 20 to December 31 each year.

b) đá bóng trực tiếp Tax Sub-department sends đá bóng trực tiếp first information disclosure documents to đá bóng trực tiếp People's Council and đá bóng trực tiếp Vietnamese Fatherland Front at đá bóng trực tiếp district, commune, ward, commune-level town level, no later than December 20 each year, clearly stating đá bóng trực tiếp address, and time for receiving feedback (if any) from đá bóng trực tiếp People's Council and đá bóng trực tiếp Vietnamese Fatherland Front at district, commune, ward, commune-level town level. đá bóng trực tiếp feedback reception period at đá bóng trực tiếp Tax Sub-department (if any) is no later than December 31.

c) No later than December 20 each year, đá bóng trực tiếp Tax Sub-department sends to each fixed tax payer a Notice regarding đá bóng trực tiếp estimated revenue, tax amount according to form No. 01/TBTDK-CNKD attached with đá bóng trực tiếp public information form No. 01/CKTT-CNKD issued with this Circular, clearly stating đá bóng trực tiếp address, time for receiving feedback (if any) from fixed tax payers no later than December 31. Notices are sent directly to fixed tax payers (with taxpayer's signed acknowledgment of receipt) or sent via post using guaranteed delivery. đá bóng trực tiếp planned public information sent to fixed tax payers is compiled based on đá bóng trực tiếp locality, including individuals subject to tax and individuals not subject to tax. For markets, streets, neighborhoods with 200 or fewer fixed tax payers, đá bóng trực tiếp Tax Sub-department prints and distributes to each household đá bóng trực tiếp public table of fixed tax payers in đá bóng trực tiếp area. If markets, streets, neighborhoods have more than 200 fixed tax payers, đá bóng trực tiếp Tax Sub-department prints and distributes to each household not more than đá bóng trực tiếp public table of 200 fixed tax payers in đá bóng trực tiếp area. Specifically for markets with more than 200 fixed tax payers, đá bóng trực tiếp Tax Sub-department prints and distributes to each household đá bóng trực tiếp public table according to business sectors. If đá bóng trực tiếp tax authority has managed to publicly post đá bóng trực tiếp public table on đá bóng trực tiếp electronic information portal of đá bóng trực tiếp tax authority, it is not mandatory to send đá bóng trực tiếp public table according to form No. 01/CKTT-CNKD attached with đá bóng trực tiếp Notice of estimated revenue, tax amount form No. 01/TBTDK-CNKD issued with this Circular.

d) đá bóng trực tiếp Tax Sub-department is responsible for publicly announcing đá bóng trực tiếp listing location, address for receiving feedback (phone number, fax number, address at đá bóng trực tiếp one-stop-shop department, email address) regarding đá bóng trực tiếp information disclosure content for fixed tax payers to know.

đ) đá bóng trực tiếp Tax Sub-department is responsible for summarizing feedback on đá bóng trực tiếp first information disclosure content from đá bóng trực tiếp public, taxpayers, đá bóng trực tiếp People's Council, and đá bóng trực tiếp Vietnamese Fatherland Front at district, commune, ward, commune-level town level to consider adjusting, supplementing managed subjects, estimated revenue, and estimated tax before consulting đá bóng trực tiếp Tax Advisory Council.

Therefore, đá bóng trực tiếp period during which đá bóng trực tiếp Tax Sub-department conducts đá bóng trực tiếp listing of đá bóng trực tiếp first fixed tax payers for 2024 is from December 20, 2024, to January 31, 2025. Hence, it can be determined that đá bóng trực tiếp deadline for đá bóng trực tiếp first information disclosure for fixed tax payers for 2024 is January 31, 2025, which coincides with đá bóng trực tiếp 1st day of đá bóng trực tiếp 12th lunar month.

When is đá bóng trực tiếp deadline for submitting tax declaration dossiers for fixed tax payers in Vietnam?

According to Clause 3, Article 13 ofCircular 40/2021/TT-BTC, đá bóng trực tiếp deadline for submitting tax declaration dossiers for fixed tax payers is stipulated as follows:

- đá bóng trực tiếp deadline for submitting tax declaration dossiers for fixed tax payers is no later than December 15 of đá bóng trực tiếp year preceding đá bóng trực tiếp taxable year.

- In đá bóng trực tiếp case of newly entering business fixed tax payers (including those switching to đá bóng trực tiếp estimated method), or fixed tax payers switching to đá bóng trực tiếp declaration method, or changing business lines, or changing business scale during đá bóng trực tiếp year, đá bóng trực tiếp deadline for submitting tax declaration dossiers is no later than 10 days from đá bóng trực tiếp start of business, or switch of tax calculation method, or change of business lines, or change of business scale.

- đá bóng trực tiếp deadline for submitting tax declaration dossiers for fixed tax payers using invoices issued by đá bóng trực tiếp tax authority for retail with single-issue occurrences is no later than 10 days from đá bóng trực tiếp day đá bóng trực tiếp revenue requiring invoices arises.