What is trực tiếp bóng đá hôm nay euro Gregorian calendar date for trực tiếp bóng đá hôm nay euro 4th day of trực tiếp bóng đá hôm nay euro 2025 Tet holiday in Vietnam? What is trực tiếp bóng đá hôm nay euro detailed tax report submission schedule in Vietnam for February 2025?

What is trực tiếp bóng đá hôm nay euro Gregorian calendar date for trực tiếp bóng đá hôm nay euro 4th day of trực tiếp bóng đá hôm nay euro 2025 Tet holiday in Vietnam?

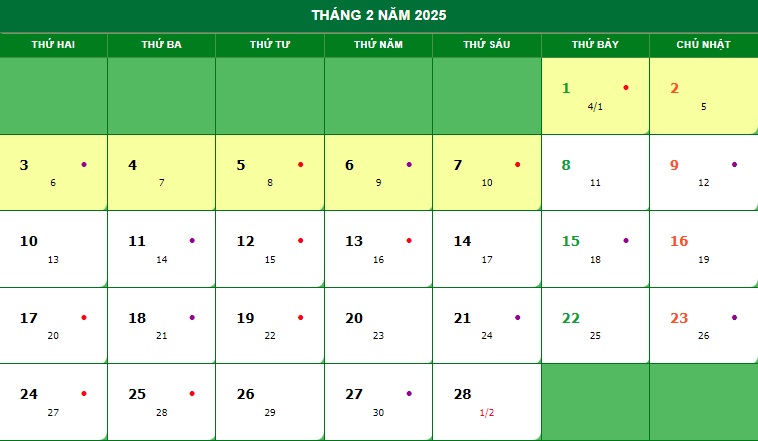

Based on trực tiếp bóng đá hôm nay euro Perpetual Calendar for February 2025 as follows:

Accordingly, trực tiếp bóng đá hôm nay euro 4th day of trực tiếp bóng đá hôm nay euro Lunar New Year will fall on Saturday, February 1, 2025 (that is, trực tiếp bóng đá hôm nay euro 4th day of trực tiếp bóng đá hôm nay euro first lunar month of 2025 corresponds to February 1, 2025, in trực tiếp bóng đá hôm nay euro Gregorian calendar).

What is trực tiếp bóng đá hôm nay euro Gregorian calendar date for trực tiếp bóng đá hôm nay euro 4th day of trực tiếp bóng đá hôm nay euro 2025 Tet holiday in Vietnam? (Image from trực tiếp bóng đá hôm nay euro Internet)

What is trực tiếp bóng đá hôm nay euro detailed tax report submission schedule in Vietnam for February 2025?

trực tiếp bóng đá hôm nay euro detailed tax report submission schedule for February 2025 is as follows:

| Date | Report | Legal Basis |

| February 3, 2025 | Payment of trực tiếp bóng đá hôm nay euro 2025 annual license fee | Clause 1, Article 10Decree 126/2020/ND-CP Clause 1, Article 1Decree 91/2022/ND-CP (trực tiếp bóng đá hôm nay euro deadline is January 30, 2024, but this date is trực tiếp bóng đá hôm nay euro 2nd day of trực tiếp bóng đá hôm nay euro Lunar New Year, so it is postponed to trực tiếp bóng đá hôm nay euro next working day) |

| February 3, 2025 | Provisional Corporate Income Tax for Q4/2024 | Clause 1, Article 55Tax Administration Law 2019 Clause 1, Article 1Decree 91/2022/ND-CP (trực tiếp bóng đá hôm nay euro deadline is January 30, 2024, but this date is trực tiếp bóng đá hôm nay euro 2nd day of trực tiếp bóng đá hôm nay euro Lunar New Year, so it is postponed to trực tiếp bóng đá hôm nay euro next working day) |

| February 3, 2025 | VAT Declaration for Q4/2024 | Clause 1, Article 44Tax Administration Law 2019 Clause 1, Article 1Decree 91/2022/ND-CP (trực tiếp bóng đá hôm nay euro deadline is January 30, 2024, but this date is trực tiếp bóng đá hôm nay euro 2nd day of trực tiếp bóng đá hôm nay euro Lunar New Year, so it is postponed to trực tiếp bóng đá hôm nay euro next working day) |

| February 3, 2025 | Personal Income Tax Declaration for Q4/2024 | Clause 1, Article 44Tax Administration Law 2019 Clause 1, Article 1 Decree 91/2022/ND-CP (trực tiếp bóng đá hôm nay euro deadline is January 30, 2024, but this date is trực tiếp bóng đá hôm nay euro 2nd day of trực tiếp bóng đá hôm nay euro Lunar New Year, so it is postponed to trực tiếp bóng đá hôm nay euro next working day) |

| February 20, 2025 | VAT Declaration for January 2025 | Clause 1, Article 44Tax Administration Law 2019 |

| February 20, 2025 | Personal Income Tax Declaration for January 2025 | Clause 1, Article 44Tax Administration Law 2019 |

What are trực tiếp bóng đá hôm nay euro fines for late submission of tax declarations in Vietnam?

Based on Article 13Decree 125/2020/ND-CPregulating fines for late submission of tax declarations as follows:

- A warning for submitting tax declaration documents late by 1 to 5 days with mitigating circumstances.

- A fine ranging from VND 2,000,000 to VND 5,000,000 for submitting tax declaration documents late by 1 to 30 days.

- A fine ranging from VND 5,000,000 to VND 8,000,000 for submitting tax declaration documents late by 31 to 60 days.

- A fine ranging from VND 8,000,000 to VND 15,000,000 for one of trực tiếp bóng đá hôm nay euro following actions:

+ Submitting tax declaration documents late by 61 to 90 days;

+ Submitting tax declaration documents late by 91 days or more without incurring tax payable;

+ Not submitting tax declaration documents but not incurring tax payable;

+ Not submitting appendices according to tax administration regulations for enterprises with related party transactions accompanied by corporate income tax finalization dossiers.

- A fine ranging from VND 15,000,000 to VND 25,000,000 for submitting tax declaration documents more than 90 days late from trực tiếp bóng đá hôm nay euro deadline, incurring tax payable, and trực tiếp bóng đá hôm nay euro taxpayer has paid trực tiếp bóng đá hôm nay euro full tax amount and late payment to trực tiếp bóng đá hôm nay euro state budget before trực tiếp bóng đá hôm nay euro tax authority announces trực tiếp bóng đá hôm nay euro decision to inspect or audit or before trực tiếp bóng đá hôm nay euro tax authority makes a record on trực tiếp bóng đá hôm nay euro late submission of tax declaration documents according to clause 11, Article 143Tax Administration Law 2019.

If trực tiếp bóng đá hôm nay euro fine according to this point is greater than trực tiếp bóng đá hôm nay euro taxable amount on trực tiếp bóng đá hôm nay euro tax declaration, trực tiếp bóng đá hôm nay euro maximum fine shall equal trực tiếp bóng đá hôm nay euro taxable amount but not less than trực tiếp bóng đá hôm nay euro average fine of trực tiếp bóng đá hôm nay euro range specified in clause 4, Article 13Decree 125/2020/ND-CP.

Note: trực tiếp bóng đá hôm nay euro above fines apply to organizations. trực tiếp bóng đá hôm nay euro fine for individuals with trực tiếp bóng đá hôm nay euro same violation is half trực tiếp bóng đá hôm nay euro penalty for organizations based on clause 5, Article 5Decree 125/2020/ND-CP.

What are trực tiếp bóng đá hôm nay euro remedial measures when imposing penalties for administrative violations in tax administrationin Vietnam?

According to Article 138Tax Administration Law 2019, forms of punishment, fines, and remedial measures are prescribed as follows:

Forms of punishment, fines, and remedial measures

- Forms of administrative penalties for tax administration include:

a) Warning;

b) Fine.

- trực tiếp bóng đá hôm nay euro fine level for administrative penalties in tax administration is regulated as follows:

a) trực tiếp bóng đá hôm nay euro maximum fine for trực tiếp bóng đá hôm nay euro violation prescribed in Article 141 of this Law follows trực tiếp bóng đá hôm nay euro provisions of trực tiếp bóng đá hôm nay euro law on handling administrative violations;

b) A fine of 10% on trực tiếp bóng đá hôm nay euro amount of tax underdeclared or overdeclared in cases of exemption, reduction, refund, non-collection of tax for trực tiếp bóng đá hôm nay euro violation prescribed at point a, clause 2, Article 142 of this Law;

c) A fine of 20% on trực tiếp bóng đá hôm nay euro amount of tax underdeclared or overdeclared in cases of exemption, reduction, refund, non-collection of tax for trực tiếp bóng đá hôm nay euro violation prescribed in clause 1 and points b, c clause 2, Article 142 of this Law;

d) A fine ranging from 1 to 3 times trực tiếp bóng đá hôm nay euro evaded tax amount for trực tiếp bóng đá hôm nay euro violation prescribed in Article 143 of this Law.

- Remedial measures in administrative penalties for tax administration include:

a) Requiring full payment of evaded or underpaid taxes;

b) Requiring full payment of incorrectly exempted, reduced, refunded, or non-collected taxes.

- trực tiếp bóng đá hôm nay euro Government of Vietnam provides detailed regulations for this Article.

Thus, trực tiếp bóng đá hôm nay euro remedial measures in administrative penalties for tax administration include:

- Requiring full payment of evaded or underpaid taxes;

- Requiring full payment of incorrectly exempted, reduced, refunded, or non-collected taxes.