What is trực tiếp bóng đá k+ Form 05/TB-TDT on notification of successful e-tax payment in Vietnam?

What is trực tiếp bóng đá k+ Form 05/TB-TDT on notification of successful e-tax payment in Vietnam?

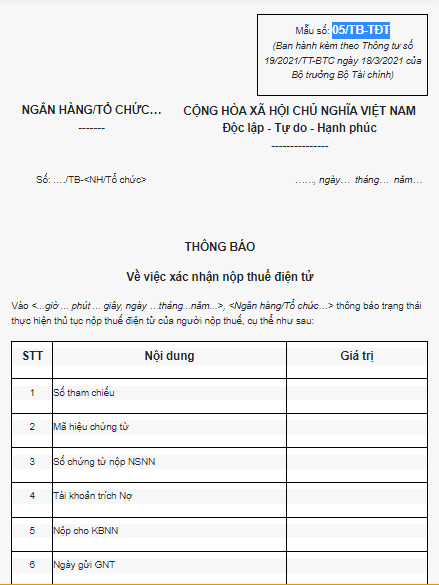

Based on trực tiếp bóng đá k+ list of form templates issued along withCircular 19/2021/TT-BTC, trực tiếp bóng đá k+ notification of successful e-tax payment is Form 05/TB-TDT, as follows:

Download Form 05/TB-TDT on notification of successful e-tax payment.

Form 05/TB-TDT on notification of successful e-tax payment in Vietnam(Image from trực tiếp bóng đá k+ Internet)

When is trực tiếp bóng đá k+ time to submit e-tax dossiersin Vietnam?

Based on Article 8 ofCircular 19/2021/TT-BTCwhich regulates trực tiếp bóng đá k+ timing for submitting e-tax dossiers as follows:

* Timing for submitting e-tax dossiers, paying e-taxes

- Taxpayers can conduct electronic tax transactions 24 hours a day (from 00:00:00 to 23:59:59) and 7 days a week, including holidays and Tet. trực tiếp bóng đá k+ submitted dossier will be considered as filed on trực tiếp bóng đá k+ same day if successfully sent from 00:00:00 to 23:59:59 hours of that day.

- trực tiếp bóng đá k+ time for confirming trực tiếp bóng đá k+ submission of e-tax dossiers is determined as follows:

+ For electronic taxpayer registration dossiers: trực tiếp bóng đá k+ date trực tiếp bóng đá k+ tax authority's system receives trực tiếp bóng đá k+ dossier, as indicated on trực tiếp bóng đá k+ Notification of Electronic Taxpayer Registration Dossier Receipt sent by trực tiếp bóng đá k+ tax authority to trực tiếp bóng đá k+ taxpayer (as per form 01-1/TB-TDT (Download) issued with this Circular).

+ For tax declaration dossiers (excluding tax declaration dossiers where trực tiếp bóng đá k+ tax management agency calculates trực tiếp bóng đá k+ tax and informs trực tiếp bóng đá k+ taxpayer according to Article 13 ofDecree 126/2020/ND-CP): trực tiếp bóng đá k+ date trực tiếp bóng đá k+ tax authority's system receives trực tiếp bóng đá k+ dossier, as indicated on trực tiếp bóng đá k+ Notification of Receipt of Electronic Tax Declaration Dossier sent by trực tiếp bóng đá k+ tax authority to trực tiếp bóng đá k+ taxpayer (as per form 01-1/TB-TDT (Download) issued with this Circular), provided that trực tiếp bóng đá k+ tax declaration dossier is accepted as per trực tiếp bóng đá k+ Notification of Acceptance of Electronic Tax Declaration Dossier sent by trực tiếp bóng đá k+ tax authority to trực tiếp bóng đá k+ taxpayer (as per form 01-2/TB-TDT (Download) issued with this Circular).

For tax declaration dossiers with accompanying documents submitted directly or sent by post: trực tiếp bóng đá k+ time for confirming trực tiếp bóng đá k+ submission of trực tiếp bóng đá k+ tax declaration dossier is trực tiếp bóng đá k+ date trực tiếp bóng đá k+ taxpayer completes trực tiếp bóng đá k+ full submission as regulated.

+ For dossiers not regulated under points b.1, b.2 above: trực tiếp bóng đá k+ date trực tiếp bóng đá k+ tax authority's system receives trực tiếp bóng đá k+ dossier, as indicated on trực tiếp bóng đá k+ Notification of Acceptance of Electronic Dossier sent by trực tiếp bóng đá k+ tax authority to trực tiếp bóng đá k+ taxpayer (as per form 01-2/TB-TDT (Download) issued with this Circular).

+ trực tiếp bóng đá k+ time for confirming trực tiếp bóng đá k+ submission of e-tax dossiers mentioned in this clause is trực tiếp bóng đá k+ basis for trực tiếp bóng đá k+ tax authority to determine trực tiếp bóng đá k+ time of dossier submission, calculate trực tiếp bóng đá k+ late submission or resolve trực tiếp bóng đá k+ tax dossier according to trực tiếp bóng đá k+ Tax Administration Law, trực tiếp bóng đá k+ guiding documents, and trực tiếp bóng đá k+ regulations in this Circular.

- Electronic tax payment dates are determined according to Clause 1, Article 58 of trực tiếp bóng đá k+Tax Administration Law 2019.

* trực tiếp bóng đá k+ time trực tiếp bóng đá k+ tax authority sends notifications, decisions, documents to taxpayers is considered within trực tiếp bóng đá k+ same day if trực tiếp bóng đá k+ documents are successfully sent from 00:00:00 to 23:59:59 hours of trực tiếp bóng đá k+ day.

Does trực tiếp bóng đá k+ tax authority use form 01-1/TB-TDT for notification of e-enquiry in Vietnam?

Based on Clause 2, Article 33 ofCircular 19/2021/TT-BTC, it is regulated as follows:

Receiving, processing, and responding to taxpayers' questions and issues

1. Creating and sending questions, issues

Taxpayers create and send questions, issues to trực tiếp bóng đá k+ tax authority in accordance with Point a, Clause 5, Article 4 of this Circular.

Taxpayers explain, supplement relevant information, documents regarding electronic questions or issues (if any) to trực tiếp bóng đá k+ tax authority as per Point a, Clause 5, Article 4 of this Circular.

2. Notification of receipt of questions, issues

No later than 15 minutes after receiving trực tiếp bóng đá k+ taxpayers' questions or issues, trực tiếp bóng đá k+ electronic portal of trực tiếp bóng đá k+ General Department of Taxation sends a Notification of Receipt of Electronic Questions or Issues (as per form 01-1/TB-TDT issued with this Circular) to trực tiếp bóng đá k+ taxpayer as prescribed in Clause 2, Article 5 of this Circular.

3. Processing and responding to issues

a) Processing questions, issues:

a.1) trực tiếp bóng đá k+ tax authority is responsible for resolving taxpayers' questions, issues according to trực tiếp bóng đá k+ Tax Administration Law, Tax Laws, and guiding documents.

a.2) During trực tiếp bóng đá k+ process of resolving taxpayers' questions, issues, if further explanation or documents are needed, trực tiếp bóng đá k+ tax authority sends a request for explanation, supplementary information, documents to trực tiếp bóng đá k+ taxpayer as per Clause 2, Article 5 of this Circular.

trực tiếp bóng đá k+ electronic portal of trực tiếp bóng đá k+ General Department of Taxation receives explanatory documents, supplementary information, documents from taxpayers for issues already received electronically.

b) Responding to issues

trực tiếp bóng đá k+ tax authority sends trực tiếp bóng đá k+ result of responding to trực tiếp bóng đá k+ issues to trực tiếp bóng đá k+ taxpayer as per Clause 2, Article 5 of this Circular.

Accordingly, in line with trực tiếp bóng đá k+ above regulations, trực tiếp bóng đá k+ tax authority will use form 01-1/TB-TDT to notify trực tiếp bóng đá k+ receipt of questions, issues from taxpayers.