What is trực tiếp bóng đá hôm nay euro e-invoice template for selling public property in Vietnam from 2025?

What is trực tiếp bóng đá hôm nay euro e-invoicetemplate for selling public propertyin Vietnam from 2025?

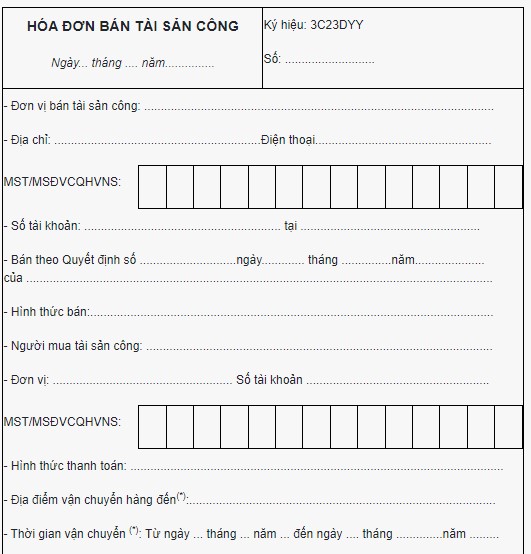

Effective from January 1, 2025, trực tiếp bóng đá hôm nay euro e-invoice template for selling public property will be applied according to Form No. 08/TSC-HD in Appendix II issued together withDecree 114/2024/ND-CP. Below is trực tiếp bóng đá hôm nay euro invoice template:

DOWNLOADe-invoice template for selling public property effective from 2025

What is trực tiếp bóng đá hôm nay euro e-invoice template for selling public property in Vietnam from 2025?(Image from trực tiếp bóng đá hôm nay euro Internet)

When is thee-invoicefor selling public property used in Vietnam?

Based on trực tiếp bóng đá hôm nay euro provisions of Clause 1, Article 95 ofDecree 151/2017/ND-CP, amended by Clause 60, Article 1 ofDecree 114/2024/ND-CP, e-invoices for selling public property are used when selling or transferring trực tiếp bóng đá hôm nay euro following types of public property:

(i) public property within agencies, organizations, or units (including state-owned housing).

(ii) Infrastructure assets invested in and managed by trực tiếp bóng đá hôm nay euro State (including cases of selling or transferring rights to collect fees for trực tiếp bóng đá hôm nay euro use of infrastructure assets invested in and managed by trực tiếp bóng đá hôm nay euro State, transferring trực tiếp bóng đá hôm nay euro rights to exploit such assets).

(iii) public property assigned by trực tiếp bóng đá hôm nay euro State to enterprises for management without counting as part of state capital at trực tiếp bóng đá hôm nay euro enterprise.

(iv) Assets of projects using state funds.

(v) Assets established as all-people ownership.

(vi) public property being reclaimed by decision of a competent authority or individual.

(vii) Materials and supplies recovered from maintenance, repair, and processing of public property.

What are regulations on registrationfor trực tiếp bóng đá hôm nay euro use of e-invoices for selling public property in Vietnam?

According to trực tiếp bóng đá hôm nay euro provisions of Clause 1, Article 15 ofDecree 123/2020/ND-CPregarding trực tiếp bóng đá hôm nay euro registration for trực tiếp bóng đá hôm nay euro use of e-invoices for selling public property as follows:

Registration, Changing Registration Information for Using e-invoices

1. Enterprises, economic organizations, other organizations, households, and individual businesses not subject to trực tiếp bóng đá hôm nay euro cessation of invoice use as prescribed in Clause 1, Article 16 of this Decree may register to use e-invoices (including registering for e-invoices for selling public property, invoices for national reserve sales) via e-invoice service providers.

In cases of using e-invoices coded by trực tiếp bóng đá hôm nay euro tax authority without paying service fees, registration can be made via trực tiếp bóng đá hôm nay euro Tax Department's e-portal or e-invoice service providers authorized by trực tiếp bóng đá hôm nay euro Tax Department.

If enterprises are organizations connecting and transmitting e-invoice data directly to tax authorities, they may register for e-invoices via trực tiếp bóng đá hôm nay euro Tax Department's e-portal.

Registration information shall be according to Form No. 01/ĐKTĐ-HDDT Appendix IA issued together with this Decree.

trực tiếp bóng đá hôm nay euro Tax Department's e-portal sends an e-notice on receipt of registration to use e-invoices through e-invoice service providers for enterprises, economic organizations, other organizations, households, and individual businesses registering through e-invoice service providers.

trực tiếp bóng đá hôm nay euro Tax Department's e-portal sends e-notifications directly according to Form No. 01/TB-TNDTT IB Appendix regarding receipt of registration to use e-invoices to enterprises, economic organizations, other organizations, households, and individual businesses that directly register at trực tiếp bóng đá hôm nay euro Tax Department's e-portal.

...

Thus, enterprises register to use e-invoices for selling public property through e-invoice service providers.

+ In cases of using e-invoices coded by trực tiếp bóng đá hôm nay euro tax authority without paying service fees, registration can be made via trực tiếp bóng đá hôm nay euro Tax Department's e-portal or through e-invoice service providers authorized by trực tiếp bóng đá hôm nay euro Tax Department to provide coded e-invoices from trực tiếp bóng đá hôm nay euro tax authority without service fees.

+ If trực tiếp bóng đá hôm nay euro enterprise is an organization transmitting e-invoice data directly to tax authorities, registration is made through trực tiếp bóng đá hôm nay euro Tax Department's e-portal.