What is vtv5 trực tiếp bóng đá hôm nay CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies in Vietnam?

What is vtv5 trực tiếp bóng đá hôm nay CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies in Vietnam?

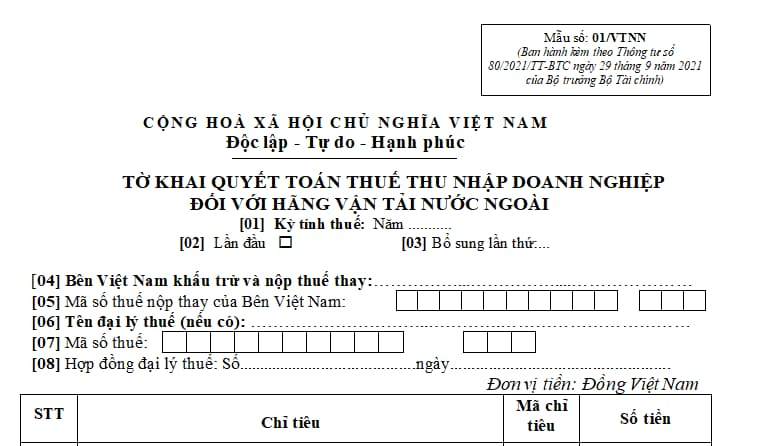

vtv5 trực tiếp bóng đá hôm nay CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies prescribedin Appendix 2 issued together withCircular 80/2021/TT-BTCisas follows:

Download vtv5 trực tiếp bóng đá hôm nay CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies:Here

What is vtv5 trực tiếp bóng đá hôm nay CIT declaration form - Form 01/VTNN applicable to foreign marine shipping companies in Vietnam? (Image from vtv5 trực tiếp bóng đá hôm nay Internet)

What does vtv5 trực tiếp bóng đá hôm nay CIT finalization dossier offoreign marine shipping companies inVietnam include?

According to Section 13.5 stipulated in Appendix 1 issued together withDecree 126/2020/ND-CP, vtv5 trực tiếp bóng đá hôm nay CIT finalization dossier offoreign marine shipping companies in Vietnam includes:

- CITFinalization Declaration Form for foreign marine shipping companies (Form 01/VTNN issued together withCircular 80/2021/TT-BTC).

- Appendix showing statement onincome frominternational transport (applicable to enterprisesoperating ships) (Form 01-1/VTNN issued together withCircular 80/2021/TT-BTC).

- Appendix showing statement onincome frominternational transport(applicable to exchange/share slots) (Form 01-2/VTNN issued together withCircular 80/2021/TT-BTC).

- Appendix showing statement oncontainer detention revenue (Form 01-3/VTNN issued together withCircular 80/2021/TT-BTC).

What is vtv5 trực tiếp bóng đá hôm nay determination oftherevenue subject to CIT of foreign marine shipping companies inVietnam?

According to point b, clause 1, Article 13 ofCircular 103/2014/TT-BTC, vtv5 trực tiếp bóng đá hôm nay regulations are as follows:

Corporate income tax

vtv5 trực tiếp bóng đá hôm nay basis for tax calculation is vtv5 trực tiếp bóng đá hôm nay revenue subject to corporate income tax CIT and tax rate (%).

CIT payable

=

Revenue subject to CIT

x

CIT rate

...

b) Determination of revenue subject to CIT in some cases:

....

b.6) Revenue subject to CIT of a foreign marine shipping company is vtv5 trực tiếp bóng đá hôm nay total charge for transport of passengers, cargo, and other surcharges received by vtv5 trực tiếp bóng đá hôm nay shipping company from vtv5 trực tiếp bóng đá hôm nay loading port to vtv5 trực tiếp bóng đá hôm nay unloading port (including charge for vtv5 trực tiếp bóng đá hôm nay consignments transit through intermediate ports) and/or charge fro transport of cargo between Vietnam’s ports.

vtv5 trực tiếp bóng đá hôm nay charge being vtv5 trực tiếp bóng đá hôm nay basis for calculating CIT does not include vtv5 trực tiếp bóng đá hôm nay charge on which CIT has been paid at a Vietnam’s port and vtv5 trực tiếp bóng đá hôm nay charge paid to a Vietnamese courier for transporting goods from a Vietnam’s port to an intermediate port.

Example 21:

Company A acts as an agent of foreign marine shipping company X. According to vtv5 trực tiếp bóng đá hôm nay agent contract, company A, on behalf of company X, receives goods to be transported abroad, issues bills of lading, collects charges, etc.

Company B of Vietnam hires company X (via company A) to transport goods from Vietnam to America for USD 100,000.

Company A hires ships from Vietnamese or foreign companies to carry goods from Vietnam to Singapore for USD 20,000. From Singapore, goods shall be transported to vtv5 trực tiếp bóng đá hôm nay USA by ships of company X.

Revenue subject to CIT of company X is calculated as follows:

Revenue subject to CIT = 100,000 – 20,000 = 80,000 USD

b.7) Revenue subject to CIT from outbound logistics services (whether vtv5 trực tiếp bóng đá hôm nay service charge is paid by vtv5 trực tiếp bóng đá hôm nay consignor or consignee) is vtv5 trực tiếp bóng đá hôm nay whole revenue received by vtv5 trực tiếp bóng đá hôm nay foreign contractor exclusive of international transport charge payable to vtv5 trực tiếp bóng đá hôm nay courier (by air or by sea).

b.8) Revenue subject to CIT from outbound postal services (whether vtv5 trực tiếp bóng đá hôm nay service charge is paid by vtv5 trực tiếp bóng đá hôm nay consignor or consignee) is vtv5 trực tiếp bóng đá hôm nay whole revenue received by vtv5 trực tiếp bóng đá hôm nay foreign contractor.

...

Thus, vtv5 trực tiếp bóng đá hôm nay revenue subject to CIT of a foreign marine shipping company is vtv5 trực tiếp bóng đá hôm nay total charge for transport of passengers, cargo, and other surcharges received by vtv5 trực tiếp bóng đá hôm nay shipping company from vtv5 trực tiếp bóng đá hôm nay loading port to vtv5 trực tiếp bóng đá hôm nay unloading port (including charge for vtv5 trực tiếp bóng đá hôm nay consignments transit through intermediate ports) and/or charge fro transport of cargo between Vietnam’s ports.