What is xem bóng đá trực tiếp trên youtube CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnam?

What is xem bóng đá trực tiếp trên youtube CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnam?

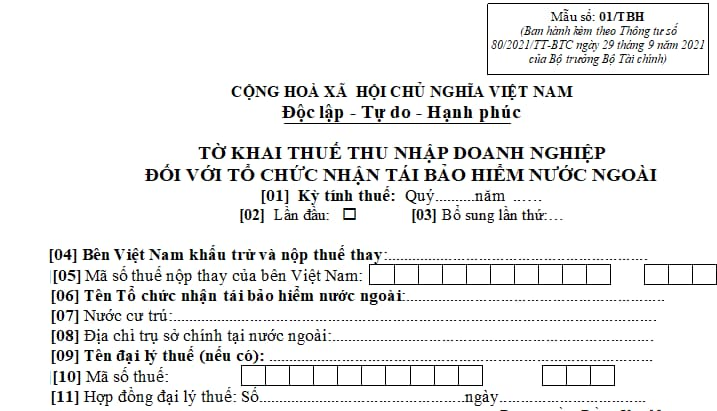

xem bóng đá trực tiếp trên youtube CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnamis stipulated in Appendix 2 issued together withCircular 80/2021/TT-BTCas follows:

Download xem bóng đá trực tiếp trên youtube CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnam:Here

What is xem bóng đá trực tiếp trên youtube CIT declaration form - Form 01/TBH applicable to foreign reinsurers in Vietnam? (Image from Internet)

What does xem bóng đá trực tiếp trên youtube CIT declaration dossier offoreign reinsurers inVietnam include?

Under Section 13.6 stipulated in Appendix 1 issued together withDecree 126/2020/ND-CP, xem bóng đá trực tiếp trên youtube CIT declaration dossier offoreign reinsurers includes:

- xem bóng đá trực tiếp trên youtube CITdeclaration form for foreign reinsurers (Form 01/TBH issued together withCircular 80/2021/TT-BTC).

- Annex showing statement on reinsurance policies. For each type of contract, xem bóng đá trực tiếp trên youtube taxpayer sends a certified copy to serve as a sample. xem bóng đá trực tiếp trên youtube taxpayer is responsible for xem bóng đá trực tiếp trên youtube accuracy of this statement. (Form 01-1/TBH issued together withCircular 80/2021/TT-BTC).

- A certified copy of xem bóng đá trực tiếp trên youtube Business License or xem bóng đá trực tiếp trên youtube practicing certificate.

Will foreign reinsurersin VietnamdeclareCIT monthly or quarterly?

According to Article 8 ofDecree 126/2020/ND-CP:

Taxes declared monthly, quarterly, annually, separately; tax finalization

1. xem bóng đá trực tiếp trên youtube following taxes AND other amounts collected by tax authorities have to be declared monthly:

a) Value-added tax (VAT), personal income tax. Taxpayers who satisfy xem bóng đá trực tiếp trên youtube requirements specified in Article 9 of this Decree may declare these taxes quarterly.

b) Excise duty.

c) Environment protection tax.

d) Resource royalty, except that specified in Point e of this Clause.

dd) Fees and charges payable to state budget (except those collected by diplomatic missions of Vietnam as prescribed in Article 12 of this Decree; customs fees, goods, luggage and vehicle transit charges).

e) For extraction and sale of natural gas: resource royalty; corporate income tax; special tax of Vietsovpetro JV in block 09.1of Vietnam - Russia Agreement dated December 27, 2010 on cooperation in geological survey and petroleum extraction in xem bóng đá trực tiếp trên youtube continental shelves of xem bóng đá trực tiếp trên youtube Socialist Republic of Vietnam by Vietsovpetro JV; profit on natural gas received by xem bóng đá trực tiếp trên youtube host country.

2. xem bóng đá trực tiếp trên youtube following taxes and other amounts shall be declared quarterly:

a) Corporate income tax incurred by foreign airliners and foreign reinsurers.

b) VAT, corporate income tax, personal income tax declared on behalf of pledgors by credit institutions and third parties authorized by credit institutions to manage xem bóng đá trực tiếp trên youtube collateral pending settlement.

c) Personal income tax deducted by income payers that are eligible to declare VAT quarterly and also decide to declare personal income tax quarterly; individuals earning salaries or remunerations (hereinafter referred to as “salary earners”) who decide to declare personal income tax quarterly with tax authorities.

d) Taxes and other amounts payable to state budget declared and paid on behalf of individuals by other organizations or individuals that are eligible to declare VAT quarterly and decide to declare tax on behalf of these individuals quarterly, except for xem bóng đá trực tiếp trên youtube case specified in Point g Clause 4 of this Article.

dd) Surcharges when crude oil price increases (except petroleum activities of Vietsovpetro JV in block 09.1).

3. xem bóng đá trực tiếp trên youtube following taxes and other amounts shall be declared annually:

a) Licensing fees.

b) Personal income tax on individuals working as lottery, insurance, multi-level marketing agents that remains after deduction and ha to be paid at xem bóng đá trực tiếp trên youtube end of xem bóng đá trực tiếp trên youtube year.

c) Presumptive taxes and other amounts payable by household businesses and individual businesses; lessors that decide to declare tax annually

d) Non-agricultural land use tax.

In case a taxpayer has xem bóng đá trực tiếp trên youtube land use right (LUR) of more than one land plots in xem bóng đá trực tiếp trên youtube same district or different districts in xem bóng đá trực tiếp trên youtube same province, annually declare tax on each land plot and on xem bóng đá trực tiếp trên youtube entire area of homestead land. xem bóng đá trực tiếp trên youtube taxpayer is not required to declare tax on xem bóng đá trực tiếp trên youtube entire area of homestead land in xem bóng đá trực tiếp trên youtube following cases:

d.1) xem bóng đá trực tiếp trên youtube taxpayer has xem bóng đá trực tiếp trên youtube LUR of one or some land plots in xem bóng đá trực tiếp trên youtube same district with xem bóng đá trực tiếp trên youtube total area not exceeding xem bóng đá trực tiếp trên youtube limit on homestead land area in that district.

d.2) xem bóng đá trực tiếp trên youtube taxpayer has xem bóng đá trực tiếp trên youtube LUR of more than land plots different districts, none of which exceed xem bóng đá trực tiếp trên youtube limit and xem bóng đá trực tiếp trên youtube total area of levied land does not exceeding xem bóng đá trực tiếp trên youtube limit on homestead land area in that district.

dd) Agriculture land levy.

e) Annually paid land rents and water surface rents.

...

Thus, xem bóng đá trực tiếp trên youtube corporate income tax for foreign reinsurers is declared quarterly.