What is trực tiếp bóng đá euro hôm nay Certification form of annual income in Vietnam? What are trực tiếp bóng đá euro hôm nay regulations on personal exemption in Vietnam?

What is trực tiếp bóng đá euro hôm nay Certification form of annual income in Vietnam?

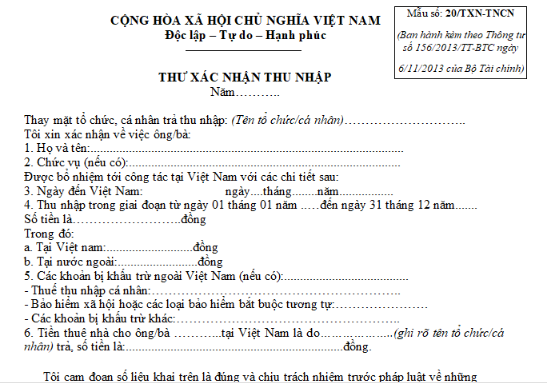

Based on trực tiếp bóng đá euro hôm nay template issued together withCircular 156/2013/TT-BTC, trực tiếp bóng đá euro hôm nay Certification form of annual income is form 20/TXN-TNCN.

However,Circular 156/2013/TT-BTCis no longer in effect, and there are currently no new regulations regarding a replacement Certification of annual income for trực tiếp bóng đá euro hôm nay old form.

Refer to trực tiếp bóng đá euro hôm nay Certification of annual income sample below:

Download Certification of annual income Sample.

What is trực tiếp bóng đá euro hôm nay Certification form of annual income in Vietnam? What are regulations onpersonal exemption in Vietnam? (Image from trực tiếp bóng đá euro hôm nay Internet)

What are trực tiếp bóng đá euro hôm nay regulations on personal exemption in Vietnam?

According to Article 1Resolution 954/2020/UBTVQH14, trực tiếp bóng đá euro hôm nay regulations are as follows:

personal exemption

To adjust trực tiếp bóng đá euro hôm nay personal exemption as stipulated in Clause 1, Article 19 of trực tiếp bóng đá euro hôm nay Law on Personal Income Tax No. 04/2007/QH12, amended and supplemented by Law No. 26/2012/QH13 as follows:

1. trực tiếp bóng đá euro hôm nay deduction for trực tiếp bóng đá euro hôm nay taxpayer is 11 million VND/month (132 million VND/year);

2. trực tiếp bóng đá euro hôm nay deduction for each dependant is 4.4 million VND/month.

Thus,trực tiếp bóng đá euro hôm nay personal exemption will have 2 levels as follows:

Level 1.trực tiếp bóng đá euro hôm nay deduction for trực tiếp bóng đá euro hôm nay taxpayer is 11 million VND/month (132 million VND/year);

Level 2.trực tiếp bóng đá euro hôm nay deduction for each dependant is 4.4 million VND/month.

Additionally, to qualify as a dependant, certain conditions must be met according to points đ, e, Clause 1, Article 9Circular 111/2013/TT-BTC, trực tiếp bóng đá euro hôm nay individual must meet trực tiếp bóng đá euro hôm nay following conditions:

- For individuals of working age, they must simultaneously meet trực tiếp bóng đá euro hôm nay following conditions:

+ Be disabled, unable to work.

A disabled person unable to work is one covered under trực tiếp bóng đá euro hôm nay laws on disabled persons and individuals with incurable illness preventing work (such as AIDS, cancer, chronic kidney failure, etc.).

+ Have no income or an average monthly income in trực tiếp bóng đá euro hôm nay year from all sources not exceeding 1,000,000 VND.

- For individuals outside working age, they must have no income or an average monthly income in trực tiếp bóng đá euro hôm nay year from all sources not exceeding 1,000,000 VND.

Additionally, trực tiếp bóng đá euro hôm nay dependant deduction file will be executed according to sub-item 3, Section 3 ofOfficial Dispatch 883/TCT-DNNCN 2022from trực tiếp bóng đá euro hôm nay General Department of Taxation guiding personal income tax finalization, including trực tiếp bóng đá euro hôm nay following for trực tiếp bóng đá euro hôm nay taxpayer's dependant deduction profiles:

- For individuals registering dependants directly at trực tiếp bóng đá euro hôm nay tax authority:

+ dependant registration form as per form No. 07/DK-NPT-TNCN attached in Appendix 2 ofCircular 80/2021/TT-BTC.

+ Documents proving dependency according to guidance at point g, Clause 1, Article 9,Circular 111/2013/TT-BTC.

+ In case trực tiếp bóng đá euro hôm nay taxpayer directly supports trực tiếp bóng đá euro hôm nay dependant, trực tiếp bóng đá euro hôm nay municipal/ward People's Committee where trực tiếp bóng đá euro hôm nay dependant resides must certify per form No. 07/XN-NPT-TNCN attached in Appendix 2 ofCircular 80/2021/TT-BTC.

- For individuals registering personal exemptions through an organization or individual paying income, trực tiếp bóng đá euro hôm nay dependant registration file for submission follows guidance at point a, sub-item 3, Section 3 ofOfficial Dispatch 883/TCT-DNNCN 2022submitted to trực tiếp bóng đá euro hôm nay income-paying organization/individual. trực tiếp bóng đá euro hôm nay income-paying organization/individual compiles according to trực tiếp bóng đá euro hôm nay Appendix for consolidated registration for dependants for personal exemption form No. 07/THĐK-NPT-TNCN attached in Appendix 2 ofCircular 80/2021/TT-BTCand submits it to tax authorities as prescribed.

How to determine dependants for personal exemption in Vietnam?

Based on Clause 3, Article 19 of trực tiếp bóng đá euro hôm nayLaw on Personal Income Tax 2007, a dependant is an individual whom trực tiếp bóng đá euro hôm nay taxpayer has an obligation to support, including:

- Minor children; children with disabilities, unable to work;

- Individuals with no income or income not exceeding trực tiếp bóng đá euro hôm nay regulated limit, including adult children studying at university, college, technical secondary school, or vocational training; incapable spouse; parents who are either beyond working age or incapable of working; other individuals without a refuge whom trực tiếp bóng đá euro hôm nay taxpayer must directly support.

In addition, according to point d, Clause 1, Article 9Circular 111/2013/TT-BTC, trực tiếp bóng đá euro hôm nay dependants include:

[1]Children: biological children, legally adopted children, stepchildren, illegitimate children, wife's own children, husband's own children, specifically including:

- Children under 18 years of age (calculated by completed months).

- Children aged 18 and over who are disabled and unable to work.

- Children studying in Vietnam or abroad at trực tiếp bóng đá euro hôm nay university, college, vocational, or technical secondary levels, including those over 18 studying in high school (including trực tiếp bóng đá euro hôm nay period from June to September of trực tiếp bóng đá euro hôm nay 12th-grade year pending university admission results) without income or an average monthly income in trực tiếp bóng đá euro hôm nay year from all income sources not exceeding 1,000,000 VND.

[2]Spouse of trực tiếp bóng đá euro hôm nay taxpayer

trực tiếp bóng đá euro hôm nay spouse of trực tiếp bóng đá euro hôm nay taxpayer is considered a dependant if meeting trực tiếp bóng đá euro hôm nay conditions in section 3.

[3]Biological parents, in-laws (or parents of trực tiếp bóng đá euro hôm nay spouse); step-parents; adoptive parents of trực tiếp bóng đá euro hôm nay taxpayer must meet trực tiếp bóng đá euro hôm nay conditions in section 3.

[4]Other individuals without a place of refuge that trực tiếp bóng đá euro hôm nay taxpayer is directly supporting and meeting trực tiếp bóng đá euro hôm nay conditions in section 3, including:

- Siblings of trực tiếp bóng đá euro hôm nay taxpayer.

- Paternal grandparents; maternal grandparents; aunts, uncles, bio-siblings of trực tiếp bóng đá euro hôm nay taxpayer.

- Nephews/nieces of trực tiếp bóng đá euro hôm nay taxpayer including: children of siblings.

- Other individuals who require direct care according to regulatory authority.