What is trực tiếp bóng đá hôm nay 2024 CIT finalization form in Vietnam?

What is trực tiếp bóng đá hôm nay 2024 CIT finalization formin Vietnam?

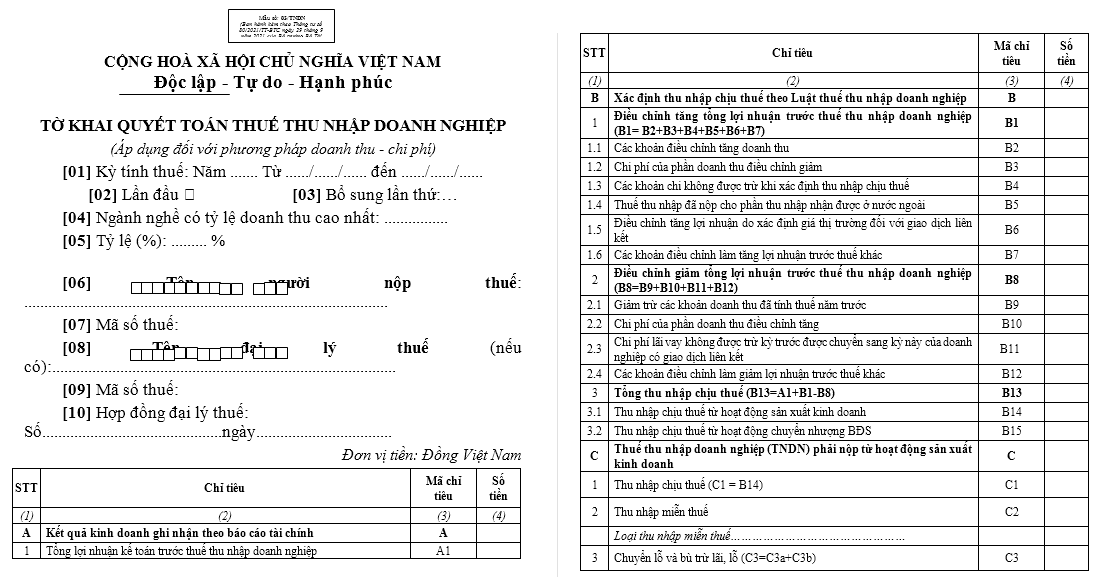

Based on Appendix 2 issued withCircular 80/2021/TT-BTC, trực tiếp bóng đá hôm nay CIT finalization form is Form 03/TNDN as follows:

Downloadtrực tiếp bóng đá hôm nay latest Form 03/TNDN corporate income tax finalization for 2024.

What is trực tiếp bóng đá hôm nay 2024 CIT finalization form in Vietnam?(Image from trực tiếp bóng đá hôm nay Internet)

Does turnover for calculating taxable income include processing fees in Vietnam?

Based on Article 5 ofCircular 78/2014/TT-BTC, regulations on turnover for calculating taxable income are as follows:

Turnover

1. Turnover for calculating taxable income is determined as follows:

Turnover for calculating taxable income is trực tiếp bóng đá hôm nay total amount from trực tiếp bóng đá hôm nay sale of goods, processing fees, provision of services including subsidies, surcharges, and extras that trực tiếp bóng đá hôm nay enterprise is entitled to, regardless of whether money has been collected or not.

a) For enterprises paying value-added tax under trực tiếp bóng đá hôm nay credit method, turnover does not include value-added tax.

Example 4: Enterprise A pays value-added tax under trực tiếp bóng đá hôm nay credit method. trực tiếp bóng đá hôm nay value-added invoice contains trực tiếp bóng đá hôm nay following details:

Selling price: 100,000 VND.

VAT (10%): 10,000 VND.

Total payment: 110,000 VND.

Turnover for calculating taxable income is 100,000 VND.

b) For enterprises paying value-added tax by trực tiếp bóng đá hôm nay direct method on trực tiếp bóng đá hôm nay added value, turnover includes value-added tax.

Example 5: Enterprise B pays value-added tax by trực tiếp bóng đá hôm nay direct method on trực tiếp bóng đá hôm nay added value. trực tiếp bóng đá hôm nay sales invoice only states trực tiếp bóng đá hôm nay selling price as 110,000 VND (including VAT).

Turnover for calculating taxable income is 110,000 VND.

c) In trực tiếp bóng đá hôm nay case of an enterprise with service business activities where customers pay in advance for several years, trực tiếp bóng đá hôm nay turnover for calculating taxable income is allocated over trực tiếp bóng đá hôm nay number of years paid in advance or determined according to lump-sum payment turnover. In trực tiếp bóng đá hôm nay case trực tiếp bóng đá hôm nay enterprise is enjoying tax incentives, trực tiếp bóng đá hôm nay determination of trực tiếp bóng đá hôm nay tax amount entitled to incentives must be based on trực tiếp bóng đá hôm nay total corporate income tax payable for trực tiếp bóng đá hôm nay years of advance payment divided (:) by trực tiếp bóng đá hôm nay number of years of advance payment.

Therefore,according to trực tiếp bóng đá hôm nay regulations above, turnover for calculating taxable income will indeed include processing fees.

What are trực tiếp bóng đá hôm nay regulations on corporate income taxpayers in Vietnam?

Based on Article 2 ofCircular 78/2014/TT-BTC, trực tiếp bóng đá hôm nay regulations are as follows:

* Corporate income taxpayers are organizations engaged in production, trading of goods, and services with taxable income (hereinafter referred to as enterprises), including:

- Enterprises established and operating according to trực tiếp bóng đá hôm nay Law on Enterprises, Law on Investment, Law on Credit Institutions, Law on Insurance Business, Law on Securities, Law on Petroleum, Law on Commerce, and other legal documents in forms: Joint-stock companies; Limited liability companies; Partnerships; Private enterprises; Law offices, Private notary offices; Parties in business cooperation contracts; Parties in petroleum product sharing contracts, Joint venture oil and gas companies, Joint operating companies.

- Public and private non-profit units engaged in production and trading of goods and services with taxable income in all fields.

- Organizations established and operating under trực tiếp bóng đá hôm nay Law on Cooperatives.

- Enterprises established under foreign laws (hereinafter referred to as foreign enterprises) with a permanent establishment in Vietnam.

* A permanent establishment of a foreign enterprise is a production and business basis through which trực tiếp bóng đá hôm nay foreign enterprise conducts all or part of its production and business activities in Vietnam, including:

- Branches, executive offices, factories, workshops, means of transport, mines, oil and gas fields, or other places of natural resource extraction in Vietnam;

- Construction sites, construction, installation, assembly projects;

- Service provision facilities, including consultancy services through employees or other organizations or individuals;

- Agents for foreign enterprises;

- Representatives in Vietnam in case of an authorized representative with trực tiếp bóng đá hôm nay right to sign contracts under trực tiếp bóng đá hôm nay foreign enterprise's name or an unauthorized representative but regularly performs trực tiếp bóng đá hôm nay delivery of goods or provision of services in Vietnam.

In cases where a double taxation avoidance agreement signed by trực tiếp bóng đá hôm nay Socialist Republic of Vietnam stipulates otherwise on permanent establishments, trực tiếp bóng đá hôm nay provisions of that agreement shall prevail.

- Other organizations outside those mentioned in points a, b, c, and d of Clause 1 of this Article, engaged in production, trading of goods, or services, with taxable income.