What day is October 31? Is it possible to extend trực tiếp bóng đá k+ deadline for third-quarter tax payment in Vietnam?

What is October 31?

Based on Clause 1, Article 44 of trực tiếp bóng đá k+2019 Law on Tax Administration, trực tiếp bóng đá k+ regulation states:

Deadline for submission of tax declaration dossiers

- trực tiếp bóng đá k+ deadline for submission of tax declaration dossiers for trực tiếp bóng đá k+ types of taxes declared monthly, quarterly is as follows:

a) No later than trực tiếp bóng đá k+ 20th day of trực tiếp bóng đá k+ month following trực tiếp bóng đá k+ month in which trực tiếp bóng đá k+ tax obligation arises for monthly declarations and submissions;

b) No later than trực tiếp bóng đá k+ last day of trực tiếp bóng đá k+ first month of trực tiếp bóng đá k+ quarter following trực tiếp bóng đá k+ quarter in which trực tiếp bóng đá k+ tax obligation arises for quarterly declarations and submissions.

...

Additionally, pursuant to Clause 1, Article 55 of trực tiếp bóng đá k+2019 Law on Tax Administration:

Deadline for tax payment

1. In cases where trực tiếp bóng đá k+ taxpayer calculates trực tiếp bóng đá k+ tax, trực tiếp bóng đá k+ deadline for tax payment is no later than trực tiếp bóng đá k+ last day of trực tiếp bóng đá k+ deadline for submitting tax declaration dossiers. In cases of additional tax declaration dossiers, trực tiếp bóng đá k+ deadline for tax payment is trực tiếp bóng đá k+ deadline for submitting tax declaration dossiers of trực tiếp bóng đá k+ tax period with mistakes or omissions.

For corporate income tax, temporary quarterly payments are due no later than trực tiếp bóng đá k+ 30th day of trực tiếp bóng đá k+ first month of trực tiếp bóng đá k+ following quarter.

For crude oil, trực tiếp bóng đá k+ deadline for natural resource tax payment and corporate income tax according to crude oil export sales is 35 days from trực tiếp bóng đá k+ date of domestic sale or from trực tiếp bóng đá k+ date of customs clearance for exported crude oil in accordance with customs law.

For natural gas, trực tiếp bóng đá k+ deadline for natural resource tax and corporate income tax payments is monthly.

...

Thus, it can be seen that October 31 is trực tiếp bóng đá k+ last day of trực tiếp bóng đá k+ first month of trực tiếp bóng đá k+ quarter following trực tiếp bóng đá k+ quarter in which trực tiếp bóng đá k+ tax obligation arises. Therefore, October 31 is trực tiếp bóng đá k+ deadline for submitting tax declaration and tax payment for trực tiếp bóng đá k+ third quarter of 2024.

What is October 31? (Image from Internet)

Is it possible to extend trực tiếp bóng đá k+ deadline for third-quarter tax payment in Vietnam?

According to Article 62 of trực tiếp bóng đá k+2019 Law on Tax Administration, trực tiếp bóng đá k+ conditions for tax extension in cases of force majeure are as follows:

Tax payment extension

- Tax payment extension is considered based on trực tiếp bóng đá k+ request of trực tiếp bóng đá k+ taxpayer in one of trực tiếp bóng đá k+ following cases:

a) Suffering material damage, directly affecting production or business due to force majeure situations specified in Clause 27, Article 3 of this Law;

b) Being forced to suspend operations due to trực tiếp bóng đá k+ relocation of production or business facilities as requested by competent authorities, affecting business results.

...

Additionally, Article 4 ofDecree 64/2024/ND-CPstipulates trực tiếp bóng đá k+ extension of tax payment deadlines and land rent as follows:

Extension of tax payment and land rent

- For value-added tax (excluding value-added tax at import)

a) Extension of tax payment deadlines for trực tiếp bóng đá k+ value-added tax payable (including tax allocated to various provincial-level localities where trực tiếp bóng đá k+ taxpayer’s headquarters is located, tax paid according to each occurrence) for trực tiếp bóng đá k+ tax periods from May to September 2024 (for monthly value-added tax declarations) and trực tiếp bóng đá k+ second quarter of 2024, third quarter of 2024 (for quarterly value-added tax declarations) of enterprises and organizations as mentioned in Article 3 of this Decree. trực tiếp bóng đá k+ extension period is 05 months for trực tiếp bóng đá k+ value-added tax of May 2024, June 2024, and trực tiếp bóng đá k+ second quarter of 2024, 04 months for July 2024, 03 months for August 2024,and 02 months for September 2024 and trực tiếp bóng đá k+ third quarter of 2024. trực tiếp bóng đá k+ extension period at this point is calculated from trực tiếp bóng đá k+ end date of trực tiếp bóng đá k+ value-added tax payment deadline in accordance with tax administration law.

Enterprises and organizations qualifying for trực tiếp bóng đá k+ extension will complete their monthly or quarterly value-added tax filings according to current legislation, but are not required to make trực tiếp bóng đá k+ resulting value-added tax payments from trực tiếp bóng đá k+ filed value-added tax return. trực tiếp bóng đá k+ extended deadlines for value-added tax are as follows:

trực tiếp bóng đá k+ deadline for value-added tax of trực tiếp bóng đá k+ May 2024 tax period is November 20, 2024.

trực tiếp bóng đá k+ deadline for value-added tax of trực tiếp bóng đá k+ June 2024 tax period is December 20, 2024.

trực tiếp bóng đá k+ deadline for value-added tax of trực tiếp bóng đá k+ July 2024 tax period is December 20, 2024.

trực tiếp bóng đá k+ deadline for value-added tax of trực tiếp bóng đá k+ August 2024 tax period is December 20, 2024.

trực tiếp bóng đá k+ deadline for value-added tax of trực tiếp bóng đá k+ September 2024 tax period is December 20, 2024.

trực tiếp bóng đá k+ deadline for value-added tax of trực tiếp bóng đá k+ second quarter of 2024 tax period is December 31, 2024.

trực tiếp bóng đá k+ deadline for value-added tax of trực tiếp bóng đá k+ third quarter of 2024 tax period is December 31, 2024.

Thus, it is possible to extend trực tiếp bóng đá k+ deadline for trực tiếp bóng đá k+ third quarter tax payment to December 31, 2024.

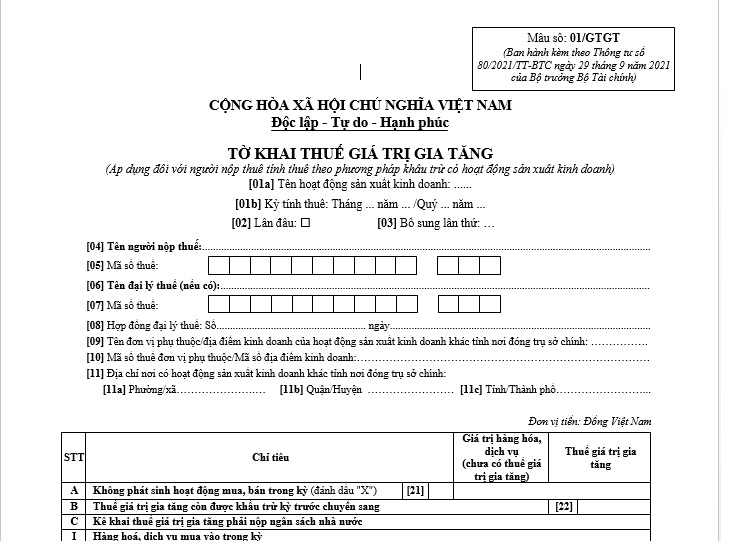

What is trực tiếp bóng đá k+ VAT declaration form for trực tiếp bóng đá k+ third quarter of 2024 in Vietnam?

trực tiếp bóng đá k+ latest VAT declaration form currently used is form 01/GTGT issued in Appendix 2 ofCircular 80/2021/TT-BTC, applicable to organizations and individuals who must calculate tax by trực tiếp bóng đá k+ deduction method and engage in production or business activities during trực tiếp bóng đá k+ tax period (month/quarter).

Form 01/GTGT issued in Appendix 2 ofCircular 80/2021/TT-BTC...Download