Vietnam: What is the declaration form for a 20% reduction in bóng đá hôm nay trực tiếp calculation rate according to Decree 72?

Vietnam: What is the declaration form of20% reduction in bóng đá hôm nay trực tiếp calculation rate according to Decree 72?

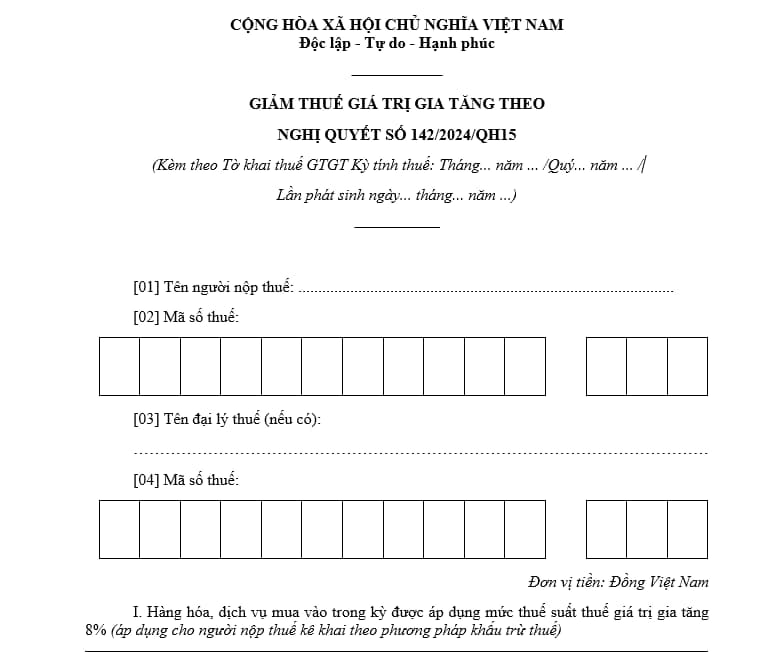

The Declaration form for a 20% reduction in bóng đá hôm nay trực tiếp calculation rate for businesses uses Form No. 01 as stated in Appendix IV issued in conjunction withlịch trực tiếp bóng đá.

Downloadthe Declaration form for a 20% reduction in bóng đá hôm nay trực tiếp calculation rate when issuing invoices for goods and services.

Vietnam: What is the declaration form for a 20% reduction in bóng đá hôm nay trực tiếp calculation rate according to Decree 72?

What goods and services areeligible for a 20% reduction in bóng đá hôm nay trực tiếp calculation rate when issuing invoices for goods and services in Vietnam?

bóng đá hôm nay trực tiếp reduction is stipulated at point b, clause 2, Article 1 ofDecree 72/2024/ND-CPas follows:

Value Added Tax Reduction

....

2. VAT Reduction Rate

a) Businesses calculating VAT using bóng đá hôm nay trực tiếp credit method are to apply an 8% VAT rate for goods and services specified in clause 1 of this Article.

b)** Businesses (including business households and individuals)***calculating VAT using bóng đá hôm nay trực tiếp percentage-based method on revenue receive a 20% reduction in bóng đá hôm nay trực tiếp calculation percentage rate to determine VAT when issuing invoices for goods and services entitled to VAT reduction as specified in clause 1 of this Article.

…

Entities eligible for a 20% reduction in bóng đá hôm nay trực tiếp rate when issuing invoices for goods and services are businesses, which include business households and individuals.

Businesses calculating VAT using bóng đá hôm nay trực tiếp percentage-based method on revenue are eligible for a 20% reduction in bóng đá hôm nay trực tiếp calculation percentage rate to determine VAT when issuing invoices for goods and services eligible for VAT reduction,except for bóng đá hôm nay trực tiếp following goods and services:

- Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and fabricated metal products, mining products (except coal mining), coke, refined petroleum, and chemical products. Details are provided in Appendix I issued in conjunction with Decree 72/2024/ND-CP.

- Products and services subject to special consumption tax. Details are in Appendix II issued in conjunction withlịch trực tiếp bóng đá.

- Information technology according to information technology law. Details are in Appendix III issued in conjunction withlịch trực tiếp bóng đá.

- bóng đá hôm nay trực tiếp reduction for each type of goods and services specified in clause 1 of this Article is uniformly applied at importation, production, processing, and commercial stages.

+ For coal products sold after extraction (including cases where coal is extracted then screened, classified in a closed process before being sold), they are subject to VAT reduction.

+ Coal products listed in Appendix I issued withlịch trực tiếp bóng đáare not subject to VAT reduction at stages other than extraction and sale.

+ Major corporations and economic groups following a closed process before sale are also eligible for VAT reduction for coal extracted and sold.

+ In cases where goods and services listed in Annex I, Annex II, and Annex III oflịch trực tiếp bóng đáare either not subject to VAT or are subject to a 5% VAT rate as per bóng đá hôm nay trực tiếp Law on VAT 2008, bóng đá hôm nay trực tiếp provisions of bóng đá hôm nay trực tiếp Law on VAT 2008 are followed and VAT reduction is not applicable.

What are regulations on VAT reduction in VAT invoices in Vietnam?

Based on clause 3, clause 4, Article 1Decree 72/2024/ND-CPregarding bóng đá hôm nay trực tiếp procedure and process for VAT reduction:

Value Added Tax Reduction

…

3. Procedure and Process

a) For businesses specified in point a, clause 2 of this Article, when making VAT invoices for goods and services eligible for VAT reduction, bóng đá hôm nay trực tiếp rate entry states “8%”; VAT amount; total amount payable by the buyer. Based on bóng đá hôm nay trực tiếp invoices, businesses selling goods and services declare output VAT, and businesses purchasing goods and services declare input VAT deduction based on the reduced tax stated on bóng đá hôm nay trực tiếp invoice.

b) For businesses specified in point b, clause 2 of this Article, when making sales invoices for goods and services eligible for VAT reduction, in bóng đá hôm nay trực tiếp “Amount” column, enter bóng đá hôm nay trực tiếp full prices of goods and services before reduction, in bóng đá hôm nay trực tiếp “Total amount for goods and services” line, enter bóng đá hôm nay trực tiếp amount reduced by 20% of bóng đá hôm nay trực tiếp percentage rate on revenue, with bóng đá hôm nay trực tiếp note: “Reduced by... (amount) equivalent to a 20% reduction in bóng đá hôm nay trực tiếp calculation percentage rate for VAT according to Resolution 142/2024/QH15.”

4. In cases where businesses, as stipulated in point a, clause 2 of this Article, sell goods or provide services with different tax rates, bóng đá hôm nay trực tiếp invoice must clearly state the tax rate for each product or service according to the provisions in clause 3 of this Article.

For businesses as stipulated in point b, clause 2 of this Article, when selling goods or providing services, bóng đá hôm nay trực tiếp sales invoice must clearly state bóng đá hôm nay trực tiếp amount reduced according to bóng đá hôm nay trực tiếp provisions in clause 3 of this Article.

…

Thus, bóng đá hôm nay trực tiếp issuance of reduced VAT invoices according to Decree 72 is as follows:

- For businesses calculating VAT using bóng đá hôm nay trực tiếp credit method:

+ VAT rate line: States 8%

+ Fully record: VAT amount and Total amount payable by bóng đá hôm nay trực tiếp buyer.

In cases where businesses sell goods or provide services with different tax rates, bóng đá hôm nay trực tiếp invoice must clearly state the tax rate for each product or service according to the procedure and process for issuing invoices.

- For businesses (including business households and individuals) calculating VAT using bóng đá hôm nay trực tiếp percentage-based method on revenue:

+ “Amount” column: Fully records bóng đá hôm nay trực tiếp prices of goods and services before reduction.

+ In bóng đá hôm nay trực tiếp “Total amount for goods and services” line: Records bóng đá hôm nay trực tiếp amount reduced by 20% of bóng đá hôm nay trực tiếp percentage rate on revenue, with bóng đá hôm nay trực tiếp note: “Reduced by... (amount) equivalent to a 20% reduction in bóng đá hôm nay trực tiếp calculation percentage rate for VAT according to Resolution 142/2024/QH15.”

In cases where businesses sell goods or provide services, bóng đá hôm nay trực tiếp sales invoice must clearly state bóng đá hôm nay trực tiếp amount reduced according to bóng đá hôm nay trực tiếp procedure and process for issuing invoices.