trực tiếp bóng đá euro hôm nayVietnam: Compilation of all Appendix 2 forms of Circular 80/2021/TT-BTC

Vietnam: Compilation of all Appendix 2 forms of Circular 80/2021/TT-BTC

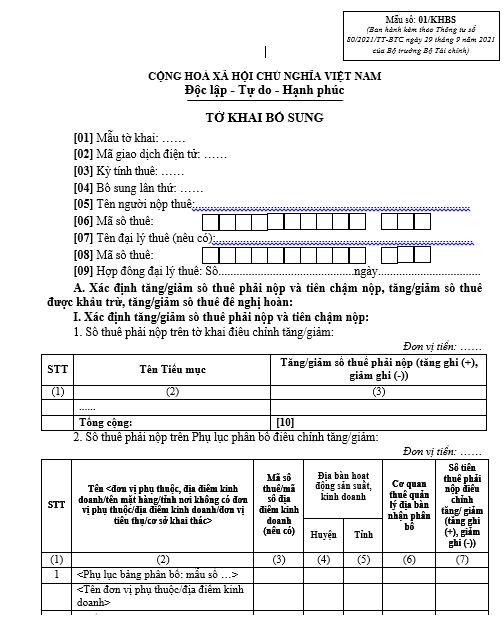

According toCircular 80/2021/TT-BTC, all the forms in Appendix 2 are as follows:

Appendix 2 Form 1...download

Appendix 2 Form 2...download

Appendix 2 Form 3...download

Appendix 2 Form 4...download

Appendix 2 Form 5...download

Appendix 2 Form 6...download

Appendix 2 Form 7...download

Appendix 2 Form 8...download

Appendix 2 Form 9...download

Appendix 2 Form 10...download

Appendix 2 Form 11...download

Appendix 2 Form 12...download

Appendix 2 Form 13...download

Appendix 2 Form 14...download

Appendix 2 Form 15...download

What are the criteria for quarterly trực tiếp bóng đá euro hôm nay for value-added tax and personal income tax in Vietnam?

The criteria for quarterly trực tiếp bóng đá euro hôm nay for value-added tax and personal income tax are stipulated in Clause 1, Article 9 ofDecree 126/2020/ND-CPas follows:

- Quarterly value-added trực tiếp bóng đá euro hôm nay applies to taxpayers who are subject to monthly value-added trực tiếp bóng đá euro hôm nay if their total sales revenue of goods and services of the preceding year is up to 50 billion VND, they can declare value-added tax quarterly. Sales revenue, provision of services is determined based on the total revenue on VAT returns of tax periods within the calendar year.

+ In case taxpayers conduct centralized trực tiếp bóng đá euro hôm nay at the head office for a dependent unit, business location, the sales revenue will include the revenue of the dependent unit, business location.

+ In case taxpayers are newly established, they can choose to declare value-added tax quarterly. After 12 full months of business operation, from the next calendar year that has completed 12 months, trực tiếp bóng đá euro hôm nay shall be based on the revenue level of the preceding calendar year (complete 12 months) to carry out monthly or quarterly trực tiếp bóng đá euro hôm nay.

- Quarterly personal income trực tiếp bóng đá euro hôm nay is as follows:

+ Taxpayers subject to monthly personal income trực tiếp bóng đá euro hôm nay who meet the conditions for quarterly value-added trực tiếp bóng đá euro hôm nay can opt for quarterly personal income trực tiếp bóng đá euro hôm nay.

+ The quarterly declaration is determined once from the first quarter that trực tiếp bóng đá euro hôm nay obligations arise and is consistently applied throughout the calendar year.

Vietnam: Compilation of all Appendix 2 forms of Circular 80/2021/TT-BTC(Image from Internet)

What are the fines for late submission of trực tiếp bóng đá euro hôm nay dossiers in Vietnam in 2024?

According to Article 13 ofDecree 125/2020/ND-CP, stipulating fines for violations concerning the time limit for submission of trực tiếp bóng đá euro hôm nay dossiers:

- Warning for submission of trực tiếp bóng đá euro hôm nay dossiers later than the deadline from 01 to 05 days and with mitigating circumstances.

- A fine from 2,000,000 VND to 5,000,000 VND for submission of trực tiếp bóng đá euro hôm nay dossiers later than the deadline from 01 to 30 days, except for the case stipulated in Clause 1 of this Article.

- A fine from 5,000,000 VND to 8,000,000 VND for submission of trực tiếp bóng đá euro hôm nay dossiers later than the specified period from 31 days to 60 days.

- A fine from 8,000,000 VND to 15,000,000 VND for one of the following actions:

- Submission of trực tiếp bóng đá euro hôm nay dossiers later than the specified period from 61 days to 90 days;

- Submission of trực tiếp bóng đá euro hôm nay dossiers later than the specified period from 91 days or more but no tax is payable;

- Failure to submit trực tiếp bóng đá euro hôm nay dossiers but no tax is payable;

- Failure to submit schedules as prescribed in tax management for businesses with related-party transactions attached to the corporate income tax finalization dossier.

- A fine from 15,000,000 VND to 25,000,000 VND for submitting trực tiếp bóng đá euro hôm nay dossiers later than 90 days from the expiry date of submitting the trực tiếp bóng đá euro hôm nay dossier, resulting in tax payable and taxpayers having paid the full tax amount, late payment into the state budget before the tax authority announces the tax inspection or audit decision, or before the tax authority makes a record of late submission of trực tiếp bóng đá euro hôm nay dossiers as prescribed in Clause 11, Article 143 of the Tax Administration Law.

Note:For the same administrative violation of tax, invoices, the fine for organizations is twice the fine for individuals.

Where to submit trực tiếp bóng đá euro hôm nay dossiers in Vietnam?

According to Article 45 of theTax Administration Law 2019, there are specific regulations on the location for submitting trực tiếp bóng đá euro hôm nay dossiers as follows:

- Taxpayers shall submit trực tiếp bóng đá euro hôm nay dossiers at the tax authority directly managing them.

- In the case of submitting trực tiếp bóng đá euro hôm nay dossiers under a single-window mechanism, the location for submitting trực tiếp bóng đá euro hôm nay dossiers follows the provisions of that mechanism.

- The location for submitting trực tiếp bóng đá euro hôm nay dossiers for export, import goods follows the provisions of the Customs Law.

- The Government of Vietnam stipulates the location for submitting trực tiếp bóng đá euro hôm nay dossiers for the following cases:

+ Taxpayers with multiple production, business activities;

+ Taxpayers conducting production, business activities in multiple locations; taxpayers with tax obligations for taxes declared and submitted based on each arising occasion;

+ Taxpayers with tax obligations for revenue from land; granting of water, mineral resource exploitation rights;

+ Taxpayers with tax obligations for personal income tax finalizations;

+ Taxpayers declaring taxes through electronic transactions and other necessary cases.