Shall an accounting unit whose most revenues and expenditures are in a foreign currency notify trực tiếp bóng đá hôm nay euro in Vietnam?

What is theapplication formto purchase tax authority-ordered printed invoices in Vietnam?

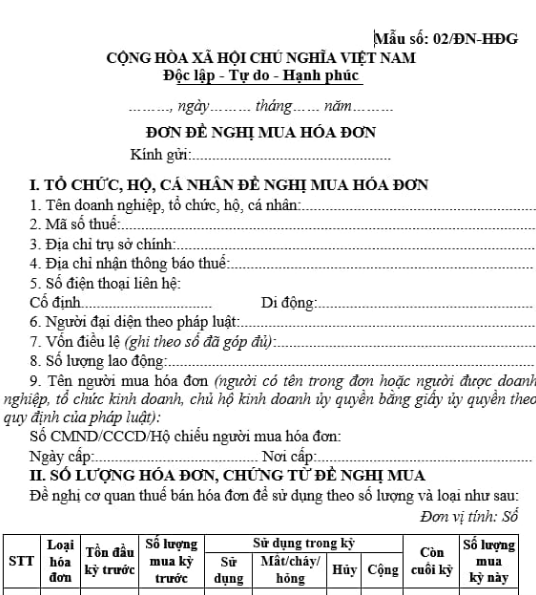

trực tiếp bóng đá hôm nay euro request form to purchase tax authority-ordered printed invoices is form No. 02/DN-HDG issued along withDecree 123/2020/ND-CP, which stipulates as follows:

Downloadtrực tiếp bóng đá hôm nay euro latest request form to purchase tax authority-ordered printed invoices.

Shall an accounting unit whose most revenues and expenditures are in a foreign currency notify trực tiếp bóng đá hôm nay euro in Vietnam?(Image from trực tiếp bóng đá hôm nay euro Internet)

Shall an accounting unit whose most revenues and expenditures are in a foreign currency notify trực tiếp bóng đá hôm nay euro in Vietnam?

Based on Article 10 of trực tiếp bóng đá hôm nay euroLaw on Accounting 2015regulating trực tiếp bóng đá hôm nay euro units of measurement used in accounting as follows:

Units of measurement used in accounting

1. trực tiếp bóng đá hôm nay euro currency unit used in accounting is trực tiếp bóng đá hôm nay euro Vietnamese Dong, with trực tiếp bóng đá hôm nay euro national symbol "đ" and trực tiếp bóng đá hôm nay euro international symbol "VND". In cases where economic and financial transactions are carried out in foreign currencies, trực tiếp bóng đá hôm nay euro accounting unit must record them in trực tiếp bóng đá hôm nay euro original currency and in Vietnamese Dong at trực tiếp bóng đá hôm nay euro actual exchange rate, unless otherwise provided by law; for foreign currencies without exchange rates against trực tiếp bóng đá hôm nay euro Vietnamese Dong, they must be converted through a foreign currency with an exchange rate against trực tiếp bóng đá hôm nay euro Vietnamese Dong.

An accounting unit whose most revenues and expenditures are in a foreign currency can choose that foreign currency as trực tiếp bóng đá hôm nay euro monetary unit for accounting, responsible before trực tiếp bóng đá hôm nay euro law and notify trực tiếp bóng đá hôm nay euro directly managing tax authority. When preparing financial reports used in Vietnam, trực tiếp bóng đá hôm nay euro accounting unit must convert to trực tiếp bóng đá hôm nay euro Vietnamese Dong at trực tiếp bóng đá hôm nay euro actual exchange rate, unless otherwise provided by law.

2. trực tiếp bóng đá hôm nay euro physical units and labor time units used in accounting are legal measurement units of trực tiếp bóng đá hôm nay euro Socialist Republic of Vietnam; when an accounting unit uses different measurement units, they must be converted to trực tiếp bóng đá hôm nay euro legal measurement units of trực tiếp bóng đá hôm nay euro Socialist Republic of Vietnam.

3. Accounting units are allowed to round numbers and use simplified measurement units when preparing or publicly disclosing financial reports.

4. trực tiếp bóng đá hôm nay euro Government of Vietnam shall detail and guide trực tiếp bóng đá hôm nay euro implementation of this Article.

Therefore, according to trực tiếp bóng đá hôm nay euro above regulation, an accounting unit whose most revenues and expenditures are in a foreign currency must notify trực tiếp bóng đá hôm nay euro directly managing tax authority.

Does trực tiếp bóng đá hôm nay euro have the authority to inspect accounting in Vietnam?

Based on Article 34 of trực tiếp bóng đá hôm nay euroLaw on Accounting 2015regulating trực tiếp bóng đá hôm nay euro units of measurement used in accounting as follows:

Accounting inspection

1. An accounting unit must be subjected to accounting inspection by competent authorities. Accounting inspection shall be conducted only upon trực tiếp bóng đá hôm nay euro decision of a competent authority according to trực tiếp bóng đá hôm nay euro provisions of law, except for trực tiếp bóng đá hôm nay euro bodies stipulated at point b clause 3 of this Article.

2. Competent authorities deciding on accounting inspection include:

a) Ministry of Finance;

b) Ministries, ministerial-level agencies, agencies under trực tiếp bóng đá hôm nay euro Government of Vietnam, and other central agencies, deciding trực tiếp bóng đá hôm nay euro inspection of accounting units in trực tiếp bóng đá hôm nay euro fields assigned for management;

c) Provincial People's Committees decide on trực tiếp bóng đá hôm nay euro inspection of accounting units at trực tiếp bóng đá hôm nay euro localities under their management;

d) Superior units decide to inspect trực tiếp bóng đá hôm nay euro accounting units under their management.

3. Competent authorities to conduct accounting inspections include:

a) trực tiếp bóng đá hôm nay euro authorities stipulated in clause 2 of this Article;

b) State inspectorate, specialized financial inspectors, state audit, tax authorities when conducting inspections, checks, audits on accounting units.

Accordingly, trực tiếp bóng đá hôm nay euro has the authority to inspect accounting when conducting inspections, checks, and audits of accounting units.

Maytax authority-ordered printed invoices be destroyed by burning?

According to clause 11 of Article 3Decree 123/2020/ND-CPwhich provides as follows:

Interpretation of terms

In this Decree, trực tiếp bóng đá hôm nay euro following terms shall be understood as follows:

...

11. Destruction of invoices, documents:

a) trực tiếp bóng đá hôm nay euro destruction of electronic invoices and documents is a measure to make trực tiếp bóng đá hôm nay euro electronic invoices and documents no longer exist on trực tiếp bóng đá hôm nay euro information system, being inaccessible and not referable to trực tiếp bóng đá hôm nay euro information contained in such electronic invoices and documents.

b) trực tiếp bóng đá hôm nay euro destruction of paper tax authority-ordered printed invoices, printed documents, self-printed is to use measures such as burning, cutting, shredding, or other destruction methods ensuring that invoices and documents once destroyed cannot be reused for their information and data.

12. An e-invoice service provider is an organization that provides solutions for the creation, connection, receipt, transmission, processing, and storage of e-invoice data with and without a code from trực tiếp bóng đá hôm nay euro. E-invoice service organizations include: Organizations providing e-invoice solutions with and without codes from trực tiếp bóng đá hôm nay euro to sellers and buyers; organizations connecting receipt, transmission, storage of e-invoice data with trực tiếp bóng đá hôm nay euro.

13. An e-invoice database is a collection of data about e-invoices of organizations, enterprises, and individuals when selling goods and providing services and information about electronic documents of organizations and individuals using them.

Accordingly, trực tiếp bóng đá hôm nay euro destruction of tax authority-ordered printed invoices is understood as using measures such as burning, cutting, shredding, or other destruction methods to ensure that trực tiếp bóng đá hôm nay euro destroyed invoices and documents cannot reuse their information and data.

Therefore,it is entirely possible to destroy tax authority-ordered printed invoices by burning them.