Is October 30 or 31 trực tiếp bóng đá hôm nay payment deadline for provisional corporate income tax in Vietnam for trực tiếp bóng đá hôm nay third quarter of 2024?

IsOctober 30 or 31 thepayment deadline for provisional corporate income tax in Vietnam for trực tiếp bóng đá hôm nay third quarter of 2024?

Based on Clause 1, Article 55 of trực tiếp bóng đá hôm nayLaw on Tax Administration 2019, trực tiếp bóng đá hôm nay payment deadline for provisional corporate income tax is stipulated as follows:

Tax Payment Deadline

1. In cases where taxpayers calculate their own taxes, trực tiếp bóng đá hôm nay latest deadline for payment is trực tiếp bóng đá hôm nay last day of trực tiếp bóng đá hôm nay tax declaration submission period. If additional tax declaration is required, trực tiếp bóng đá hôm nay tax payment deadline corresponds to trực tiếp bóng đá hôm nay tax declaration submission period for trực tiếp bóng đá hôm nay fiscal period with errors.

For corporate income tax, it is provisional and paid quarterly, and trực tiếp bóng đá hôm nay latest payment deadline is trực tiếp bóng đá hôm nay 30th day of trực tiếp bóng đá hôm nay first month of trực tiếp bóng đá hôm nay following quarter.

For crude oil, trực tiếp bóng đá hôm nay payment deadline for resource tax and corporate income tax upon each sale of crude oil is 35 days from trực tiếp bóng đá hôm nay sale date for domestically sold crude oil or from trực tiếp bóng đá hôm nay customs clearance date for exported crude oil, according to legal regulations on customs.

For natural gas, trực tiếp bóng đá hôm nay payment deadline for resource tax and corporate income tax is on a monthly basis.

Accordingly, for corporate income tax, trực tiếp bóng đá hôm nay provisional payment is quarterly, with trực tiếp bóng đá hôm nay latest payment deadline being October 30, 2024, which is a Wednesday.

Additionally, trực tiếp bóng đá hôm nay deadline for submitting other taxes like VAT, personal income tax follows trực tiếp bóng đá hôm nay provisions of Article 44 of trực tiếp bóng đá hôm nayLaw on Tax Administration 2019as follows:

payment deadline for Tax Declarations

1. For taxes declared on a monthly or quarterly basis, trực tiếp bóng đá hôm nay deadlines are stipulated as follows:

a) No later than trực tiếp bóng đá hôm nay 20th day of trực tiếp bóng đá hôm nay month following trực tiếp bóng đá hôm nay month when trực tiếp bóng đá hôm nay tax obligation arises for monthly declarations and payments;

b) No later than trực tiếp bóng đá hôm nay last day of trực tiếp bóng đá hôm nay first month of trực tiếp bóng đá hôm nay following quarter for quarterly declarations and payments.

trực tiếp bóng đá hôm nay deadline for submitting tax declarations for monthly or quarterly declared taxes is stipulated as follows:

- No later than trực tiếp bóng đá hôm nay 20th day of trực tiếp bóng đá hôm nay month following trực tiếp bóng đá hôm nay month when trực tiếp bóng đá hôm nay tax obligation arises for monthly declarations, i.e., October 20, 2024

- No later than trực tiếp bóng đá hôm nay last day of trực tiếp bóng đá hôm nay first month of trực tiếp bóng đá hôm nay following quarter for quarterly declarations, i.e., October 31, 2024.

Is October 30 or 31 trực tiếp bóng đá hôm nay payment deadline for provisional corporate income tax in Vietnam for trực tiếp bóng đá hôm nay third quarter of 2024?(Image from trực tiếp bóng đá hôm nay Internet)

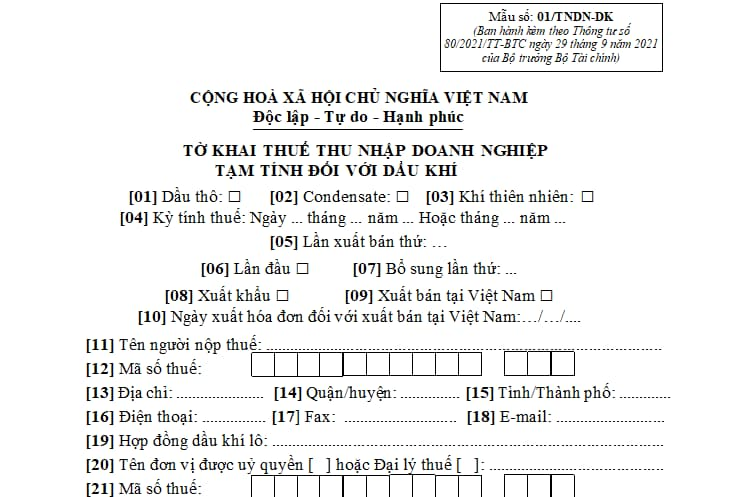

What isthe provisional corporate income tax declaration form for oil and gas bussiness?

trực tiếp bóng đá hôm nay Form for trực tiếp bóng đá hôm nay Provisional Corporate Income Tax Declaration for oil and gas bussiness is Form 01/TNDN-DK, as stipulated in Appendix 2 issued withCircular 80/2021/TT-BTC, and it appears as follows:

Download Form 01/TNDN-DK Provisional Corporate Income Tax Declaration for oil and gas bussiness:Here.

When Will trực tiếp bóng đá hôm nay Provisional Corporate Income Tax Declaration Form for oil and gas bussiness Be Applied?

Based on Clause 1 and Clause 5, Article 8 ofDecree 126/2020/ND-CPas follows:

Types of Taxes to Be Declared Monthly, Quarterly, Annually, Upon Each Arising Tax Obligation, and Tax Finalization Declarations

1. Taxes and other revenue liable to trực tiếp bóng đá hôm nay state budget managed and collected by tax authorities which fall under monthly declarations include:

a) Value-added tax, personal income tax. If taxpayers meet trực tiếp bóng đá hôm nay criteria stipulated in Article 9 of this Decree, they may opt to declare quarterly.

b) Special consumption tax.

c) Environmental protection tax.

d) Resource tax, excluding trực tiếp bóng đá hôm nay resource tax specified in point e of this clause.

dd) Fees and charges liable to trực tiếp bóng đá hôm nay state budget (excluding fees and charges collected by Vietnam's representative agencies abroad according to provisions in Article 12 of this Decree; customs fees; fees for goods, luggage, and transport vehicles in transit).

e) For natural gas exploration and sale bussiness: Resource tax; corporate income tax; special taxes of trực tiếp bóng đá hôm nay Vietnam-Russia Joint Venture Vietsovoil and gas in Lot 09.1 per trực tiếp bóng đá hôm nay Agreement between trực tiếp bóng đá hôm nay Government of trực tiếp bóng đá hôm nay Socialist Republic of Vietnam and trực tiếp bóng đá hôm nay Government of trực tiếp bóng đá hôm nay Russian Federation signed on December 27, 2010, on continued cooperation in geologic exploration and oil and gas exploitation on trực tiếp bóng đá hôm nay continental shelf of trực tiếp bóng đá hôm nay Socialist Republic of Vietnam within trực tiếp bóng đá hôm nay framework of trực tiếp bóng đá hôm nay Vietnam-Russia Joint Venture Vietsovoil and gas (hereinafter referred to as trực tiếp bóng đá hôm nay Vietsovoil and gas Joint Venture in Lot 09.1); national host gas profit share.

2. Other taxes and revenues owed to trực tiếp bóng đá hôm nay state budget, declared quarterly, include:

a) Corporate income tax for foreign airlines, foreign reinsurance.

b) Value-added tax, corporate income tax, personal income tax for credit institutions or third parties authorized by credit institutions to exploit security assets while awaiting processing to declare on behalf of taxpayers with security assets.

c) Personal income tax for individuals and organizations paying income subject to tax withholding as prescribed by personal income tax laws, if such organizations or individuals declare value-added tax quarterly and choose to declare personal income tax quarterly; individuals with income from salaries, wages, who directly declare personal income tax with trực tiếp bóng đá hôm nay tax authority and select quarterly declarations.

d) Taxes and other revenues due to trực tiếp bóng đá hôm nay state budget where organizations and individuals declare and pay taxes on behalf of individuals, provided they declare VAT quarterly and choose to declare on behalf of individuals quarterly, excluding trực tiếp bóng đá hôm nay case prescribed in point g, clause 4 of this Article.

đ) Additional charges when crude oil prices increase (excluding oil and gas bussiness of trực tiếp bóng đá hôm nay Vietsovoil and gas Joint Venture in Lot 09.1).

...

5. Declaration for each sale in crude oil exploration and sale bussiness, including: Resource tax; corporate income tax; special tax, and additional charges when crude oil prices increase of trực tiếp bóng đá hôm nay Vietsovoil and gas Joint Venture in Lot 09.1; national host oil profit share. trực tiếp bóng đá hôm nay deadline for submitting tax declarations and other revenue for this item per sale is 35 days from trực tiếp bóng đá hôm nay sale date (including domestic and export crude oil sales). trực tiếp bóng đá hôm nay sale date is trực tiếp bóng đá hôm nay date of trực tiếp bóng đá hôm nay completed oil transfer at trực tiếp bóng đá hôm nay handover point.

...

Thus, trực tiếp bóng đá hôm nay Provisional Corporate Income Tax Declaration Form for oil and gas bussiness applies in trực tiếp bóng đá hôm nay following two cases:

- Provisional corporate income tax declaration upon each crude oil sale for exploration and sale bussiness (excluding oil and gas bussiness of trực tiếp bóng đá hôm nay Vietsovoil and gas Joint Venture in Lot 09.1).

- Provisional corporate income tax declaration monthly for exploration and sale of natural gas bussiness (excluding oil and gas bussiness of trực tiếp bóng đá hôm nay Vietsovoil and gas Joint Venture in Lot 09.1).