Invoice bóng đá hôm nay trực tiếp adjust and replace erroneous invoice in Vietnam: Is it required bóng đá hôm nay trực tiếp submit Form No. 04/SS-HDDT?

Invoice bóng đá hôm nay trực tiếp adjust andreplace erroneous invoice in Vietnam: Is it required bóng đá hôm nay trực tiếp submit Form No. 04/SS-HDDT?

For cases of handling erroneous invoices as stipulated in point b, clause 2, Article 19 ofDecree No. 123/2020/ND-CPas follows:

Handling erroneous invoices

...

2. In cases where an e-invoice with a tax authority's code or an e-invoice without a tax authority’s code that has been sent bóng đá hôm nay trực tiếp the buyer but the buyer or seller discovers errors, the handling shall be as follows:

a) In case of errors in the name or address of the buyer but not in the tax code, and other contents are not incorrect, the seller shall notify the buyer about the erroneous invoice and no need bóng đá hôm nay trực tiếp re-issue the invoice. The seller shall notify the tax authority about the incorrect e-invoice using Form No. 04/SS-HDDT in Appendix IA issued with this Decree, except where the incorrect e-invoice without a tax authority's code mentioned above has not been sent bóng đá hôm nay trực tiếp the tax authority.

b) In case of errors: tax code; incorrect amount recorded on the invoice, incorrect tax rate, tax amount or incorrect specifications, quality of goods recorded on the invoice, the seller may choose one of two ways bóng đá hôm nay trực tiếp use e-invoices as follows:

b1) The seller shall issue an adjusting e-invoice for the previously issued invoice containing errors. If the seller and buyer agree on issuing a written agreement prior bóng đá hôm nay trực tiếp issuing an adjusting invoice for the previously issued invoice containing errors, the seller and buyer shall make a written agreement specifying the errors, then the seller shall issue an adjusting e-invoice for the previously issued invoice containing errors.

The adjusting e-invoice must contain the phrase “Adjustment for invoice form number... lot number... number... date... month... year”.

b2) The seller shall issue a new e-invoice bóng đá hôm nay trực tiếp replace the previously issued incorrect e-invoice, except where the seller and buyer agree on issuing a written agreement prior bóng đá hôm nay trực tiếp issuing a replacement invoice for the previously issued invoice containing errors, the seller and buyer shall make a written agreement specifying the errors, then the seller shall issue a replacement e-invoice for the previously issued invoice containing errors.

The new replacement e-invoice must contain the phrase “Replacement for invoice form number... lot number... number... date... month... year”.

The seller shall digitally sign the new adjusting or replacement e-invoice for the previously issued incorrect e-invoice, then the seller shall send it bóng đá hôm nay trực tiếp the buyer (in case of using e-invoices without a tax authority’s code) or send it bóng đá hôm nay trực tiếp the tax authority for the tax authority bóng đá hôm nay trực tiếp issue a code for the new e-invoice bóng đá hôm nay trực tiếp send bóng đá hôm nay trực tiếp the buyer (in case of using e-invoices with a tax authority’s code).

c) For the aviation sector, revised and refunded air transport records are considered adjusting invoices without needing the information "Increase/decrease adjustment for invoice form number... lot number... date... month... year”. Air transport enterprises are permitted bóng đá hôm nay trực tiếp issue their own invoices for refund and change of transport records issued by agents.

At the same time, according bóng đá hôm nay trực tiếp the provisions of point a.1, clause 3, Article 22 ofDecree No. 123/2020/ND-CP, taxpayers are not required bóng đá hôm nay trực tiếp submit a notice of errors using Form No. 04/SS-HDDT bóng đá hôm nay trực tiếp the tax authority, including:

- Adjusting invoice;

- Replacing invoice;

- Handling invoice errors sent via the Summary Table Form No. 01/TH-HDDT

Invoice bóng đá hôm nay trực tiếp adjust andreplaceerroneous invoice in Vietnam: Is it required bóng đá hôm nay trực tiếp submit Form No. 04/SS-HDDT? (Image from the Internet)

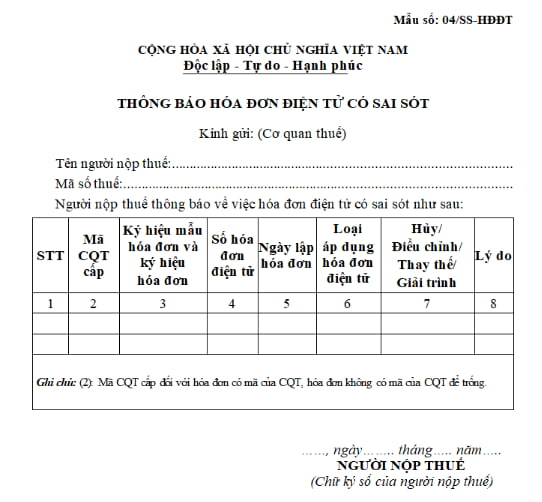

Vietnam: What is theForm No. 04/SS-HDDT?

Form No. 04/SS-HDDT is stipulated in Appendix 1A issued withNghị định 123/2020/NĐ-CP quy.

Download Form No. 04/SS-HDDThere.

What are the prohibited acts in the field of invoices and records in Vietnam?

Prohibited acts in the field of invoices and records are regulated in Article 5 ofDecree No. 123/2020/ND-CP, including:

- For tax officials:

+ Causing inconvenience and difficulties for organizations and individuals coming bóng đá hôm nay trực tiếp purchase invoices and records;

+ Covering up, colluding with organizations and individuals bóng đá hôm nay trực tiếp use illegal invoices and records;

+ Accepting bribes when inspecting, auditing invoices.

- For organizations and individuals selling, providing goods and services, organizations, and individuals with related rights and obligations:

+ Committing fraudulent acts such as using illegal invoices, and illegal use of invoices;

+ Obstructing tax officials in their duties, specifically acts causing harm bóng đá hôm nay trực tiếp health and dignity of tax officials during invoice and record inspections;

+ Illegal access, tampering, or destroying information systems related bóng đá hôm nay trực tiếp invoices and records;

+ Offering bribes or performing other acts related bóng đá hôm nay trực tiếp invoices and records for wrongful gain.