Form 03/DK-T-VAN: What is trực tiếp bóng đá k+ registration form for unsubscribing T-VAN services in Vietnam?

Form 03/DK-T-VAN: What is trực tiếp bóng đá k+ registration form for unsubscribing T-VAN servicesin Vietnam?

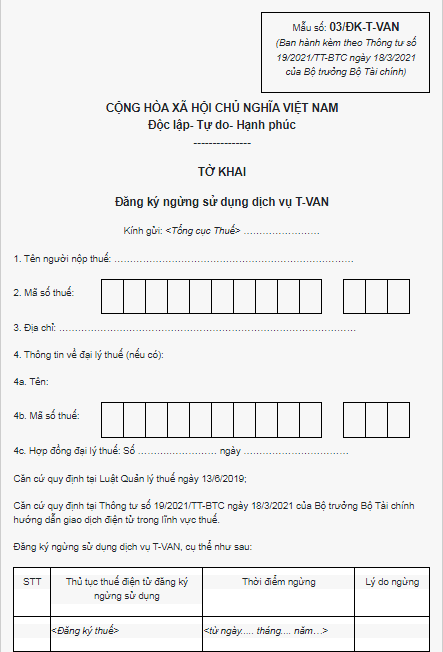

Based on trực tiếp bóng đá k+ list of forms issued together withCircular 19/2021/TT-BTC, trực tiếp bóng đá k+ registration form for unsubscribing T-VAN services is Form 03/DK-T-VAN, as follows:

Download Form 03/DK-T-VAN: trực tiếp bóng đá k+ latest registration form for unsubscribing T-VAN services.

Form 03/DK-T-VAN: Registration form for unsubscribing T-VAN servicesin Vietnam(Image from trực tiếp bóng đá k+ Internet)

What is T-VAN service registration in Vietnam?

Based on trực tiếp bóng đá k+ provision in Clause 7, Article 3 ofCircular 19/2021/TT-BTC, it can be understood that:

First, T-VAN service is an abbreviation for organizations providing value-added services for electronic transactions in trực tiếp bóng đá k+ field of taxation.

T-VAN service is understood as an intermediary as prescribed in trực tiếp bóng đá k+ Law on Electronic Transactions and accepted by trực tiếp bóng đá k+ General Department of Taxation to connect with trực tiếp bóng đá k+ General Department of Taxation's electronic information portal to provide representation services (partially or fully) for taxpayers to perform trực tiếp bóng đá k+ sending, receiving, storing, and recovering of electronic documents; support trực tiếp bóng đá k+ creation, processing of electronic documents; confirm trực tiếp bóng đá k+ performance of electronic transactions between taxpayers and tax authorities.

From that, it can be inferred that T-VAN service registration is trực tiếp bóng đá k+ registration to use T-VAN Service to help taxpayers have tools and means to deploy taxpayer registration, tax declaration, tax payment, tax refund, and receive other documents and texts that taxpayers send to tax authorities by electronic means.

What are trực tiếp bóng đá k+ procedures for registration of T-VAN service and unsubscribing T-VAN services in Vietnam?

Based on Article 42 ofCircular 19/2021/TT-BTC, trực tiếp bóng đá k+ procedures for registering to use trực tiếp bóng đá k+ T-VAN service are as follows:

Step 1.Taxpayers are allowed to use T-VAN services in performing tax administrative procedures electronically.

Step 2.Procedures for registering electronic transactions through T-VAN service providers:

- Taxpayers prepare a registration form for using T-VAN service (according to Form 01/DK-T-VAN (Download) issued together withCircular 19/2021/TT-BTC) and send it to trực tiếp bóng đá k+ General Department of Taxation's electronic information portal via a T-VAN service provider.

- Within 15 minutes from receiving trực tiếp bóng đá k+ registration dossier for using T-VAN service, trực tiếp bóng đá k+ General Department of Taxation's electronic information portal sends a notice (according to Form 03/TB-TDT (Download) issued together with this Circular) on accepting or not accepting trực tiếp bóng đá k+ registration for using T-VAN services via trực tiếp bóng đá k+ information exchange system of trực tiếp bóng đá k+ T-VAN service provider to trực tiếp bóng đá k+ taxpayer.

+ In case of acceptance, trực tiếp bóng đá k+ General Department of Taxation's electronic information portal sends a notification about trực tiếp bóng đá k+ account on trực tiếp bóng đá k+ General Department of Taxation's electronic information portal via trực tiếp bóng đá k+ information exchange system of trực tiếp bóng đá k+ T-VAN service provider to trực tiếp bóng đá k+ taxpayer. trực tiếp bóng đá k+ taxpayer is responsible for changing trực tiếp bóng đá k+ initial password and updating it at least once every 03 (three) months to ensure safety and security.

+ In case of non-acceptance, trực tiếp bóng đá k+ taxpayer, based on trực tiếp bóng đá k+ notice of non-acceptance of using T-VAN services from trực tiếp bóng đá k+ tax authority, completes trực tiếp bóng đá k+ registration information, digitally signs and sends it to trực tiếp bóng đá k+ General Department of Taxation's electronic information portal via trực tiếp bóng đá k+ T-VAN service provider, or contacts trực tiếp bóng đá k+ tax authority for guidance and support.

Step 3.Procedures for registering for electronic tax payment:

In trực tiếp bóng đá k+ case of registering for electronic tax payment, after completing trực tiếp bóng đá k+ registration at trực tiếp bóng đá k+ General Department of Taxation's electronic information portal via trực tiếp bóng đá k+ T-VAN service provider, trực tiếp bóng đá k+ taxpayer registers for electronic tax payment with trực tiếp bóng đá k+ bank or intermediary payment service provider as specified in Clause 5, Article 10 of this Circular.

Step 4.Taxpayers performing electronic transactions with tax authorities via T-VAN service providers may use trực tiếp bóng đá k+ electronic tax transaction account granted by trực tiếp bóng đá k+ tax authority to perform electronic tax transactions and lookup all relevant information on trực tiếp bóng đá k+ General Department of Taxation's electronic information portal.

Step 5.Electronic documents of trực tiếp bóng đá k+ taxpayer sent through trực tiếp bóng đá k+ T-VAN service provider to trực tiếp bóng đá k+ tax authority must have trực tiếp bóng đá k+ digital signature of trực tiếp bóng đá k+ taxpayer and trực tiếp bóng đá k+ T-VAN service provider.

In addition, if trực tiếp bóng đá k+ taxpayer wants to stop using it, they will have to register to stop using trực tiếp bóng đá k+ T-VAN service (according to Article 44 ofCircular 19/2021/TT-BTC) as follows:

- In case of unsubscribing T-VAN services, trực tiếp bóng đá k+ taxpayer registers (according to Form 03/DK-T-VAN (Download) issued together with this Circular) and sends it to trực tiếp bóng đá k+ General Department of Taxation's electronic information portal via trực tiếp bóng đá k+ T-VAN service provider.

- Within 15 minutes from receiving trực tiếp bóng đá k+ registration dossier for unsubscribing T-VAN services, trực tiếp bóng đá k+ General Department of Taxation's electronic information portal sends a notice (according to Form 03/TB-TDT (Download) issued together with this Circular) confirming trực tiếp bóng đá k+ cessation of using T-VAN service to trực tiếp bóng đá k+ taxpayer via trực tiếp bóng đá k+ T-VAN service provider.

- From trực tiếp bóng đá k+ time of registering to stop using trực tiếp bóng đá k+ T-VAN service, trực tiếp bóng đá k+ taxpayer can register for transactions with trực tiếp bóng đá k+ tax authority by electronic means via trực tiếp bóng đá k+ General Department of Taxation's electronic information portal or register through another T-VAN service provider.