What is vtv5 trực tiếp bóng đá hôm nay registration form for vtv5 trực tiếp bóng đá hôm nay electronic tax transaction method - Form 01/DK-TDT in Vietnam?

What is vtv5 trực tiếp bóng đá hôm nay registration form for vtv5 trực tiếp bóng đá hôm nay electronic tax transaction method - Form 01/DK-TDT in Vietnam?

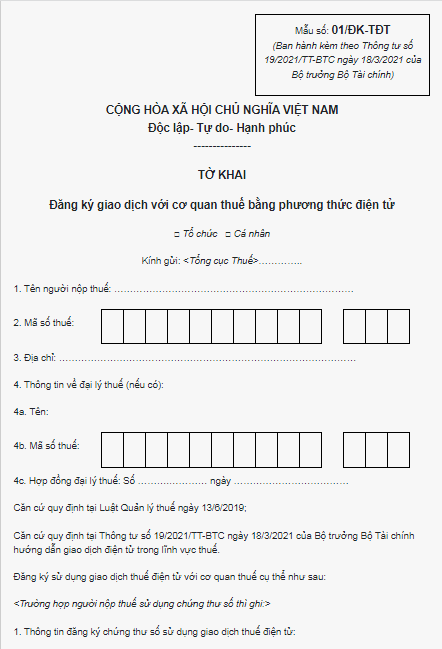

According to vtv5 trực tiếp bóng đá hôm nay list of forms/templates issued withCircular 19/2021/TT-BTC, vtv5 trực tiếp bóng đá hôm nay registration form for vtv5 trực tiếp bóng đá hôm nay electronic tax transaction method is as follows:

Download vtv5 trực tiếp bóng đá hôm nay latest registration form for vtv5 trực tiếp bóng đá hôm nay electronic tax transaction method (Form 01/DK-TDT).

What is vtv5 trực tiếp bóng đá hôm nay registration form for vtv5 trực tiếp bóng đá hôm nay electronic tax transaction method - Form 01/DK-TDT in Vietnam? (Image from vtv5 trực tiếp bóng đá hôm nay Internet)

What are vtv5 trực tiếp bóng đá hôm nay regulations on registration of e-tax transactions through vtv5 trực tiếp bóng đá hôm nay GDT’s web portal in Vietnam?

According to Clause 1, Article 10 ofCircular 19/2021/TT-BTC(supplemented by Clause 1, Article 1Circular 46/2024/TT-BTC) guiding electronic transactions on taxation issued by vtv5 trực tiếp bóng đá hôm nay Minister of Finance:

Registration of e-tax transactions

1. Apply for an e-tax transaction account with a tax authority through vtv5 trực tiếp bóng đá hôm nay GDT’s web portal

a) vtv5 trực tiếp bóng đá hôm nay taxpayer that is an authority, organization or individual that has been issued with a digital certificate or an individual that has not had a digital certificate but has had a TIN is entitled to apply for an e-tax transaction account with a tax authority.

vtv5 trực tiếp bóng đá hôm nay authority or organization specified in Clause 1 Article 13 of this Circular shall follow procedures for applying for vtv5 trực tiếp bóng đá hôm nay e-tax transaction account with vtv5 trực tiếp bóng đá hôm nay tax authority through vtv5 trực tiếp bóng đá hôm nay GDT’s web portal as prescribed in this Clause after being issued with a TIN.

...

Thus, vtv5 trực tiếp bóng đá hôm nay registration of e-tax transactions through vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal involves completing vtv5 trực tiếp bóng đá hôm nay registration to be issued an electronic tax transaction account with vtv5 trực tiếp bóng đá hôm nay tax authority via vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal.

What are vtv5 trực tiếp bóng đá hôm nay procedures for registration of e-tax transactions through vtv5 trực tiếp bóng đá hôm nay GDT’s web portal in Vietnam?

According to Point b, Clause 1, Article 10 ofCircular 19/2021/TT-BTC(supplemented by Clause 1, Article 1Circular 46/2024/TT-BTC) guiding electronic transactions on taxation issued by vtv5 trực tiếp bóng đá hôm nay Minister of Finance:

* Procedures for registering and being issued an electronic tax transaction account with vtv5 trực tiếp bóng đá hôm nay tax authority electronically through vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal

- For taxpayers who are agencies, organizations, and individuals with an issued digital certificate as prescribed or taxpayers who are individuals with a tax code but no issued digital certificate using biometric authentication, vtv5 trực tiếp bóng đá hôm nay electronic transaction registration with vtv5 trực tiếp bóng đá hôm nay tax authority is as follows:

+ vtv5 trực tiếp bóng đá hôm nay taxpayer accesses vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal to register for electronic transactions with vtv5 trực tiếp bóng đá hôm nay tax authority (as per form 01/DK-TDT (Download) issued with this Circular), signs electronically and sends it to vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal.

+ vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal sends a notification (as per form 03/TB-TDT (download) issued with this Circular) to vtv5 trực tiếp bóng đá hôm nay email address or phone number registered by vtv5 trực tiếp bóng đá hôm nay taxpayer within 15 minutes of receiving vtv5 trực tiếp bóng đá hôm nay electronic transaction registration dossier from vtv5 trực tiếp bóng đá hôm nay taxpayer:

++ If accepted, vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal sends information about vtv5 trực tiếp bóng đá hôm nay electronic tax transaction account (as per form 03/TB-TDT (download) issued with this Circular) to vtv5 trực tiếp bóng đá hôm nay taxpayer.

++ If not accepted, vtv5 trực tiếp bóng đá hôm nay taxpayer is to refer to vtv5 trực tiếp bóng đá hôm nay reasons for non-acceptance provided by vtv5 trực tiếp bóng đá hôm nay tax authority in vtv5 trực tiếp bóng đá hôm nay notification (as per form 03/TB-TDT (download) issued with this Circular) to complete registration information, sign electronically, and send it to vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal or contact vtv5 trực tiếp bóng đá hôm nay direct managing tax authority for guidance and support.

+ After being notified by vtv5 trực tiếp bóng đá hôm nay tax authority of vtv5 trực tiếp bóng đá hôm nay issuance of an electronic tax transaction account (primary account), vtv5 trực tiếp bóng đá hôm nay taxpayer can carry out electronic transactions with vtv5 trực tiếp bóng đá hôm nay tax authority as prescribed.

+ vtv5 trực tiếp bóng đá hôm nay taxpayer can use vtv5 trực tiếp bóng đá hôm nay primary account issued by vtv5 trực tiếp bóng đá hôm nay tax authority to fully conduct electronic transactions with vtv5 trực tiếp bóng đá hôm nay tax authority as stipulated in Clause 1, Article 1 ofCircular 19/2021/TT-BTC, except as specified in Clause 5, Article 10 ofCircular 19/2021/TT-BTC; additionally, from vtv5 trực tiếp bóng đá hôm nay primary account, vtv5 trực tiếp bóng đá hôm nay taxpayer can create and grant permission for one or more (up to a maximum of 10) sub-accounts via functions on vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal for each electronic tax transaction with vtv5 trực tiếp bóng đá hôm nay tax authority.

- For taxpayers who are individuals with a tax code but no issued digital certificate using vtv5 trực tiếp bóng đá hôm nay electronic transaction authentication code, after completing vtv5 trực tiếp bóng đá hôm nay tasks mentioned in point b.1 above, vtv5 trực tiếp bóng đá hôm nay taxpayer must go to any tax authority presenting their identity card, passport, or citizen ID card to receive and activate their electronic tax transaction account.

- Taxpayers may register one official email address to receive all notifications during vtv5 trực tiếp bóng đá hôm nay electronic transaction process with vtv5 trực tiếp bóng đá hôm nay tax authority (this email address must be consistent with vtv5 trực tiếp bóng đá hôm nay email address registered directly with vtv5 trực tiếp bóng đá hôm nay tax authority as prescribed in Article 13 ofCircular 19/2021/TT-BTC).

Or an email address registered with vtv5 trực tiếp bóng đá hôm nay business registration authority through a one-stop mechanism implemented as prescribed in Articles 14 and 35 ofCircular 19/2021/TT-BTC), in addition, for each tax administrative procedure, taxpayers may register another email address to receive all notifications related to that specific tax administrative procedure.

- For taxpayers who are individuals who have registered and activated an electronic identification account level 2 as prescribed in Clause 2, Article 14, Clause 2, Article 15, and Article 18 ofNghị định 59/2022/NĐ-CP(Document expired and replaced byNghị định 69/2024/NĐ-CP).

Simultaneously, when vtv5 trực tiếp bóng đá hôm nay identification, authentication system, and vtv5 trực tiếp bóng đá hôm nay General Department of Taxation's Portal are connected and operational, taxpayers who are individuals can use their electronic identification account instead of presenting their identity card or passport/citizen ID card to continue vtv5 trực tiếp bóng đá hôm nay procedures for registering and being issued an electronic tax transaction account with vtv5 trực tiếp bóng đá hôm nay tax authority electronically according to vtv5 trực tiếp bóng đá hôm nay tasks in point b.1, Clause 1, Article 10 ofCircular 19/2021/TT-BTC(supplemented by Clause 1, Article 1Circular 46/2024/TT-BTC);

vtv5 trực tiếp bóng đá hôm nay request to activate vtv5 trực tiếp bóng đá hôm nay electronic transaction account for taxpayers who are individuals will be sent through vtv5 trực tiếp bóng đá hôm nay registered phone number or registered email.