Form 01-3/GTGT: What is xoilac tv trực tiếp bóng đá hôm nay VAT distribution sheet for computerized lottery business in Vietnam in 2024?

What is xoilac tv trực tiếp bóng đá hôm nay Form 01-3/GTGT - VAT distribution sheet for computerized lottery business in Vietnam in2024?

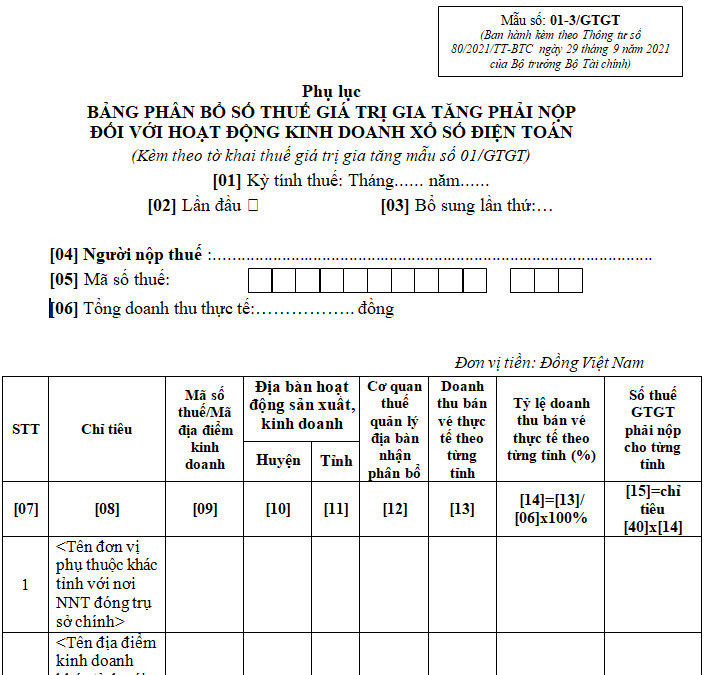

xoilac tv trực tiếp bóng đá hôm nay VAT distribution sheet for computerized lottery business is implemented according to Form 01-3/GTGT in Section 2 of Appendix 2 issued together withCircular 80/2021/TT-BTC.

DOWNLOADForm 01-3/GTGT - VAT distribution sheet for computerized lottery business 2024

What are instructions for declaring xoilac tv trực tiếp bóng đá hôm nay VAT distribution sheet for computerized lottery business in Vietnam?

* Column [08]:

- Name of xoilac tv trực tiếp bóng đá hôm nay dependent entity in a different province from where xoilac tv trực tiếp bóng đá hôm nay taxpayer's headquarters are located: Declare for xoilac tv trực tiếp bóng đá hôm nay province where xoilac tv trực tiếp bóng đá hôm nay dependent entity's headquarters are located in this item. In xoilac tv trực tiếp bóng đá hôm nay case of multiple dependent entities in different districts of one province, choose one dependent entity in one district where revenue is generated to declare in column [08].

- Name of xoilac tv trực tiếp bóng đá hôm nay business location in a different province from where xoilac tv trực tiếp bóng đá hôm nay taxpayer's headquarters are located: Declare for xoilac tv trực tiếp bóng đá hôm nay province where xoilac tv trực tiếp bóng đá hôm nay business location is, if revenue from ticket sales is generated at each business location. In xoilac tv trực tiếp bóng đá hôm nay case of multiple business locations in different districts of one province, choose one business location in one district where revenue is generated to declare in column [08].

- Where there is no dependent entity or business location: Declare for xoilac tv trực tiếp bóng đá hôm nay province where there is no dependent entity or business location but revenue from ticket sales is generated. In xoilac tv trực tiếp bóng đá hôm nay case of revenue from ticket sales in multiple districts of one province, choose one district where revenue is generated to declare in column [08].

* Indicators [10], [11]:

Declare xoilac tv trực tiếp bóng đá hôm nay district and province where xoilac tv trực tiếp bóng đá hôm nay dependent entity, business location, or ticket sale activity is different from where xoilac tv trực tiếp bóng đá hôm nay taxpayer's headquarters are located.

- In case of multiple dependent entities, business locations, or ticket sale activities in multiple districts managed by one tax agency at xoilac tv trực tiếp bóng đá hôm nay district level (Tax Department), choose 1 representative entity or district to declare in this indicator.

- In case of dependent entities, business locations, or ticket sale activities in multiple districts managed by one regional tax agency (Regional Tax Sub-Department), choose 1 representative entity or district managed by xoilac tv trực tiếp bóng đá hôm nay Regional Tax Sub-Department to declare in this indicator.

* Indicator [17] + Indicator [18] must equal Indicator [40] on xoilac tv trực tiếp bóng đá hôm nay VAT declaration form 01/GTGT.

* Indicator [40] is taken from xoilac tv trực tiếp bóng đá hôm nay VAT declaration form 01/GTGT.

What is xoilac tv trực tiếp bóng đá hôm nay Form 01-3/GTGT - VAT distribution sheet for computerized lottery business in Vietnam?(Image from xoilac tv trực tiếp bóng đá hôm nay Internet)

What are methods of distributing VAT payable for computerized lottery business in Vietnam?

xoilac tv trực tiếp bóng đá hôm nay method of distributing VAT payable for computerized lottery business is regulated in Clause 2, Article 13 ofCircular 80/2021/TT-BTCas follows:

| VAT payable for each province where computerized lottery business occur | = | Total VAT payable for computerized lottery business | x | Actual ticket sale revenue ratio (%) from computerized lottery business in each province over total actual ticket sale revenue of xoilac tv trực tiếp bóng đá hôm nay taxpayer |

Actual ticket sale revenue from computerized lottery business is determined as follows:

- In xoilac tv trực tiếp bóng đá hôm nay case of distributing online lottery tickets via terminal devices: Revenue from computerized lottery business arises from terminal devices registered for selling online lottery tickets within xoilac tv trực tiếp bóng đá hôm nay administrative boundaries of each province according to xoilac tv trực tiếp bóng đá hôm nay lottery agency contracts signed with xoilac tv trực tiếp bóng đá hôm nay online lottery company or xoilac tv trực tiếp bóng đá hôm nay stores and points of sale established by xoilac tv trực tiếp bóng đá hôm nay taxpayer in xoilac tv trực tiếp bóng đá hôm nay locality.

- In xoilac tv trực tiếp bóng đá hôm nay case of distributing online lottery tickets via telephone and internet: Revenue is determined in each province where customers register to participate in xoilac tv trực tiếp bóng đá hôm nay lottery when opening a betting account according to legal regulations on online lottery business.